Loading...

White paper summary: Business-owner clients present planning opportunities for you

Key takeaways

- Business succession is one of the most critical aspects of business ownership, yet only 30% of small-business owner have a formal succession plan

- Planning early is critical to optimize the business’s marketability and provide the owner with the necessary time to prepare emotionally and financially for stepping away

- A funded buy/sell agreement will be necessary for many business transitions

The importance of succession planning

While their business is such a vital part of a business owner’s financial, personal and emotional life, many owners don’t realize that if they step away without proper planning, those important factors may be lost.

In the next 10 years, 73% of business owners over the age of 43 would like to exit their business.1 This shift represents an estimated $14 trillion in wealth transfer and is expected to create a substantial impact on the American business landscape, opening up many opportunities for financial professionals.

While a business owner may think that the transition of their business is too far in the future or is such a remote possibility that they do not need to plan for it, sometimes the transition happens before they intend it to. A business owner may leave their business for many reasons, such as death, disability, divorce, family emergency or a conflict with business partners.

Not having a succession plan at all is risky, and planning too late can also create problems. Helping your business-owner clients put a solid, funded succession plan in place is an extremely valuable service you can provide.

The 4 stages of succession planning

Stage 1: Discovery

Discovery includes fact-finding and establishing the goals

of the business owner.

- Considering potential successors

- Timeline — how long until transition

- Assessing owner readiness

Stage 2: Planning/discussing options

In stage 2, you’ll use the information you gathered in discovery to present viable options to your client.

- Determine the successor(s)

- Determine the fair market value of the company

- Determine preliminary terms and triggers of the

buy/sell agreement

Stage 3: Implementation of the plan

Establish the paperwork needed.

- Formalize the buy/sell agreement and related succession documents

- Fund the agreement

Stage 4: Periodic review

Ensure that the plan still fits and that there is enough funding.

Your business-owner clients may not know what they need to do to protect their businesses, nor realize that succession planning is most effective when done well in advance. By following the 4 stages of succession planning, you can help your business-owner clients achieve key goals:

- Preservation of the value of the business

- Harmony among stakeholders

- A smooth transition whatever the trigger may be

- Financial security

Our full-length white paper elaborates on the 4 stages and includes a hypothetical case study of a small business that put a succession plan in place.

Download the white paper

[1] “Preserving a legacy: The importance of succession planning,” Forbes & Company, July 2024.

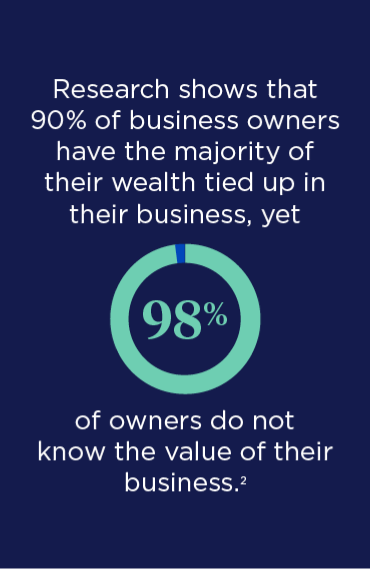

[2] “Discover What Your Business is Worth,” BizEquity.com June 6, 2024.