Loading...

Business succession made easier

Leverage our 4 simple steps to help owners plan a more successful exit.

Succession planning for business-owner clients

Whether your business-owner clients are just beginning to think about their exit or are actively planning for the future, our checklist offers a practical way to organize their thoughts and take the next steps with confidence.

Why it matters

Early planning offers more options to:

- Maximize business value

- Identify the right buyer

- Fund the plan effectively

The document asks and answers some questions to provide your client with context:

- What is business succession planning?

- What are the consequences of not having a business succession strategy?

The value of business succession planning

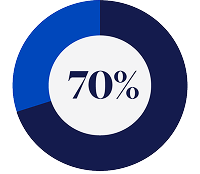

of small businesses currently lack a succession plan1

Succession planning often overlaps with retirement income strategies, offering you an opportunity to strengthen your relationships with business-owner clients and expand your role as a trusted financial professional.

Small-business owners face the dual challenges of day-to-day operations and trying to grow the business, leaving many unprepared for an intentional exit.

Your involvement in succession planning can position you as a valued resource for the next generation of owners, potentially leading to future opportunities.

4 key steps to business succession

Step 1

Set goals and objectives.

Step 2

Determine the fair market value of the company.

Step 3

Consider possible exit and succession options.

Step 4

Enter into and decide how to fund the buy/sell agreement.

The checklist also outlines key areas your clients may need to plan for, both before and after the business transition. These considerations not only help protect your client’s business and family members, but also open valuable planning opportunities.

These include:

- Key employee retention and protection

- Income replacement planning

- Estate equalization and liquidity

- Long-term care needs

- Retirement and legacy goals

Our client-facing checklist helps clients get to know the components of this important process and encourages them to work with you to execute it.

Share the checklist with your business-owner clients to start more productive

planning conversations.

[1] "PwC's 2023 US Family Business Survey," pwc.com/us/en/services/audit-assurance/private-company-services/library/family-business-survey.html (May 16, 2023).