Loading...

White paper summary: The new "medical IRA", using an HSA for tax-free retirement income

Key takeaways

- Most people use an HSA to contribute money each year and then withdraw it that same year to pay for current medical expenses.

- Keeping funds invested in an HSA for many years allows clients to take advantage of the potential for tax-free growth over many years — similar to investing in an IRA.

- Maximizing HSA contributions can lower an individual’s tax liability — a big benefit, especially for high-earners.

- Saving receipts of qualified medical expenses is key, because the client could withdraw HSA funds as reimbursements years or even decades later.

- Educating clients on the short- and long-term potential of HSAs is another way to strengthen your relationships with them.

Our white paper, “The new ‘medical IRA’: Using an HSA for tax-free retirement income,” can help you explain to clients why keeping funds invested in a health savings account for many years may give them an extra resource to pay for out-of-pocket health care costs in retirement.

Access paper

Most people use a health savings account (HSA) to contribute money each year and then withdraw it that same year to pay for current medical expenses. However, keeping funds invested in an HSA for many years allows clients to take advantage of the potential for tax-free growth — similar to investing in an IRA.

As a financial professional, you can demonstrate your expertise and further strengthen client relationships by educating them on this forward-thinking strategy.

The “medical IRA” strategy

Most people use an HSA as simply a tax-advantaged savings account. While this approach is beneficial in the short run, it doesn’t help them plan for their health care costs during retirement — which could be significant.1

An alternate approach involves keeping funds invested in the HSA for many years to take advantage of the potential for tax-free growth over time — similar to investing in an IRA.2

The key steps include:

- The HSA is held within an account with a selection of investment options

- The HSA investment allocation is aligned with the client’s retirement accounts

- The client contributes to the HSA each year — ideally up to the maximum

- As medical costs are incurred, the client pays for them out of pocket, saving all receipts reflecting HSA-eligible expenses

- Saving receipts is key, because there’s no time limit on HSA reimbursements

Example of potential account growth

If a client who is eligible to contribute up to $8,750 per year — or approximately $729 per month — keeps up that contribution level for 15 years and makes more withdrawals, they'll have $231,065 at age 65 (assuming a 7% annual rate of return).

They could then withdraw funds tax-free to spend on a wide range of health care costs — including Medicare premiums, prescription drugs, co-pays and more.

Lowering income taxes with an HSA

Money that’s contributed to an HSA lowers the amount of income subject to federal, state and FICA taxes. That in turn lowers an individual’s tax liability — a big benefit, especially for high-earners.

Talk to your clients about HSAs

If you haven’t yet discussed HSAs with your clients, consider downloading our white paper to prepare for upcoming client meetings.

For more information about the benefits of HSAs and other strategies for preparing for health care costs in retirement, visit our health care costs webpage.

Older couple walking through forest together

Nationwide CareMatters®

This single-life coverage is for clients who are primarily looking for long-term care coverage and want to be able to recover their costs if they never need care.

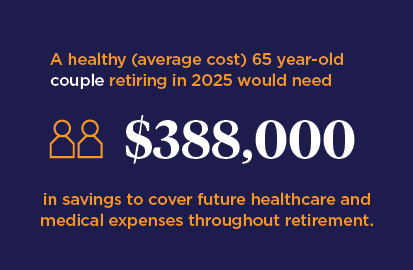

[1] "2025 Milliman Retiree Health Cost Index," Milliman, Robert Schmidt and Eric Walters, https://www.milliman.com/en/insight/retiree-health-cost-index-2025

[2] HSAs are not taxed at a federal income tax level when used appropriately for qualified medical expenses. Also, most states, but not all, recognize HSA funds as tax-free. Please consult a tax advisor regarding your state’s specific rules.

Federal income tax laws are complex and subject to change. This information is based on current interpretations of the law; it is not guaranteed and has not been endorsed by any government agency. This information is general in nature and is not intended to be tax, legal, accounting or other professional advice.

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.

Before investing, clients should consider the investment's objectives, risks, charges and expenses. Investing involves market risk including loss of principal.