Loading...

Answers to the 3 most common Medicare questions

There’s no doubt that Medicare can be confusing — especially at first. But understanding the basics of this program is key to helping your clients make decisions that will work for their health care needs and their budgets. Read on for answers to the top three questions people have about Medicare.

1. How much does Medicare cost?

Many people don’t realize that Medicare isn’t free. In reality, there are a variety of potential costs involved. That’s why estimating the cost of Medicare (and related health care expenses) is an important part of planning ahead for retirement.

In addition to Medicare premiums, deductible, co-insurance amounts and the costs of Medigap or Medicare Advantage plans, your clients may also have to pay premium add-ons for Medicare Part B or Part D plans. As shown below, it depends on their modified adjusted gross income (MAGI) and tax filing status.

Medicare monthly premium calculation, 2026 based on 2024 income:

| Single MAGI1 |

Couple MAGI |

Part B Premium with income related surcharge1 |

Part D Surcharges |

| < $109,000 |

< $218,000 |

$202.90 |

Premium (varies) |

| $109,001 to $137,000 |

$218,001 to $274,000 |

$284.10 |

Premium + $14.50 |

| $137,001 to $171,000 |

$274,001 to $342,000 |

$405.80 |

Premium + $37.50 |

| $171,001 to $205,000 |

$342,001 to $410,000 |

$527.50 |

Premium + $60.40 |

| $205,001 to $500,000 |

$410,001 to $750,000 |

$649.20 |

Premium + $83.30 |

| > $500,000 |

> $750,000 |

$689.90 |

Premium + $91.00 |

2. What do the parts of Medicare cover?

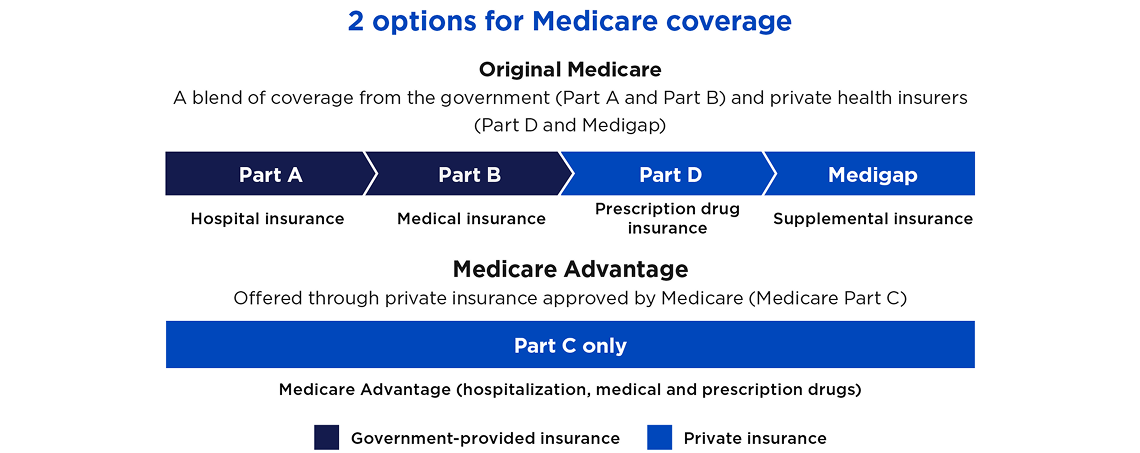

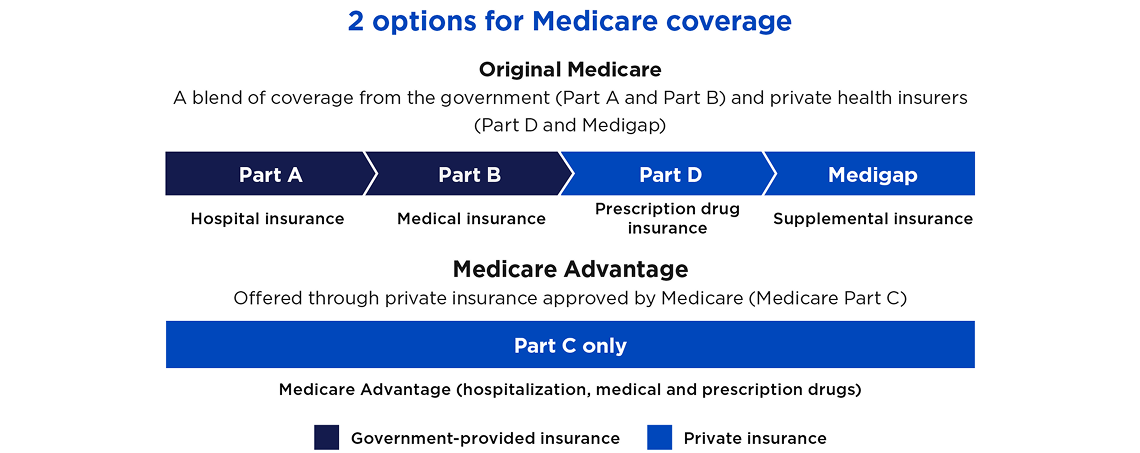

There are multiple “parts” to Medicare, each with its own benefits. Clients can purchase either “Original Medicare,” which includes Parts A (hospitalization) and B (outpatient services), and then tack on Part D (prescription drugs) and Medigap (a supplemental coverage policy to help with the out-of-pocket costs not covered by Original Medicare), or they can purchase a Medicare Advantage plan under Part C. Medicare Advantage plans cover most of the same medically necessary services as Original Medicare, plus some additional benefits.

3. What’s not covered by Medicare Part A and Part B?

Original Medicare doesn’t cover everything. Some of the main costs not covered by Original Medicare include:

- Most dental and vision care

- Routine hearing care (including hearing aids)

- Most foot care

- Long-term care

- Alternative medicine

- Nonemergency transportation

For these and other out-of-pocket costs, most people choose to supplement with private (Medigap) insurance. Medigap plans don’t provide stand-alone benefits; instead, they coordinate with Medicare benefits to reduce an individual’s share of health care costs.

[1] "2025 Medicare Parts A & B Premiums and Deductibles," cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles (Nov. 8, 2024).