Loading...

Medicare expense planning

Medicare is a huge part of several complex decisions that clients will need to make as they approach retirement. At age 65, most individuals will have access to the Medicare program and many choices they’ll need to consider for their health care going forward. Our Medicare program provides education and insights to help simplify the complexities of Medicare and project what costs might look like both now and down the road.

View our resources

Couple sitting on a bench, looking at a tablet

Why does understanding Medicare matter?

As a financial professional, you may not need to be an expert on Medicare, but you do need to be prepared for questions from your clients. Your familiarity with Medicare expense planning positions you to:

- Prepare clients for a potentially overlooked retirement expense that might impact their retirement income needs

- Many clients are used to health care premiums being paid for through automatic deductions from their paycheck

- Medicare isn’t free and premiums will need to be funded from their retirement income assets

- Plan for uncovered expenses. Plan for uncovered expenses, such as caregiving expenses needed for clients as they age; get ahead of this potential expense and consider LTC coverage or HSAs to help prepare for to out-of-pocket expenses

- Build your practice and deepen knowledge

- Many financial professionals may not be aware of how Medicare and Social Security work together and the subsequent impacts to a client’s retirement.

- Offering client resources and education can set you apart in your community, without offering Medicare coverage yourself

What do clients need to consider when planning for Medicare?

What does Medicare cover?

Medicare consists of 2 parts. Part A covers hospital stays and Part B is for doctor visits. Some people choose to supplement with private insurance — Part D, for prescription drug coverage, and Medigap, which covers out-of-pocket costs.

Medicare doesn’t cover all health care services. There are exclusions for most dental and vision care, long-term care, alternative medicine and nonemergency transportation, among other services.

How and when to enroll for Medicare

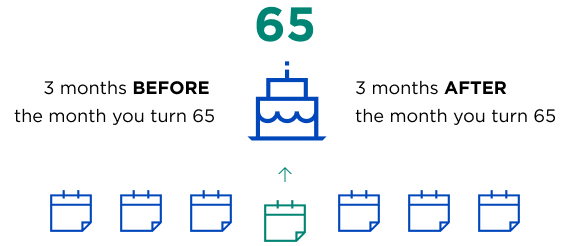

If your client is already collecting Social Security, they’ll be automatically enrolled in Parts A and B the first day of the month they turn 65; if they're not already collecting Social Security, they should enroll during their 7-month Initial Enrollment Period (see chart).

If they want to enroll in a Medicare Advantage plan, they need to first enroll in Part A and/or Part B to obtain a Medicare number, then initiate a switch to Medicare Advantage.

Impacts of Medicare on retirement:

Medicare and Social Security benefits are linked, but each individual’s specific situation can affect eligibility and costs associated.

- To qualify for Medicare your client must be eligible to collect Social Security benefits (or have a qualifying disability or disease)

- Medicare premiums can be deducted from your client’s Social Security check

Make sure your clients are planning for aging

As people live longer, there is an increasing likelihood that they’ll need long-term care at some point in their lives. Original Medicare or Medigap services do not cover custodial or long-term care coverage. You have an opportunity to discuss stand-alone long-term care insurance, life insurance with a long-term care rider or linked-benefit long-term care insurance as options for clients.

Why turn to Nationwide® as a trusted resource?

We’re here to support you and your clients as you dive into the Medicare selections and health care costs your clients will need to pay for in retirement.

The Nationwide Retirement Institute® has leveraged the expertise of the National Council on Aging (NCOA) and partnered with them to build educational content and offer resources to help your clients navigate the important choices related to Medicare. We’ve also partnered with HealthView Services to offer a planning tool that helps you prepare those clients who are 10+ years out from retirement.

The Nationwide Retirement Institute’s Medicare program outlines the basics of Medicare, explains the enrollment process and clarifies the Medicare surcharges and uncovered costs your more affluent clients may face. Learn more through:

Check out our videos

As your clients age, health care and long-term care costs become a real concern. Learn how Nationwide can support your discussions with clients about the need to prepare for these potential expenses.

Review the videos

A Black man in a gray blazer sits behind his laptop at his desk in a business office.

Start the Medicare conversation with your clients

Our Health Care/LTC Cost Assessment Fact Finder can help you estimate your client’s future Medicare premiums and health care costs. Our partnership with HealthView Services uses actuarial science to deliver a customized report. By completing our fact finder with client-specific information, you will receive a report that:

- Estimates a client’s annual Medicare premiums and out-of-pocket expenses

- Enables you to more accurately forecast Medicare and health-related retirement income needs for your clients

- Provides potential costs to plug into your financial software to build a long-term income plan that adequately addresses Medicare premiums and health care expenses

The Nationwide Retirement Institute Planning Team can assist with strategies, case design and income planning needs.