Loading...

Home health care and the caregiver crisis in America

Key topics

- Being an informal caregiver can be stressful and take a financial toll

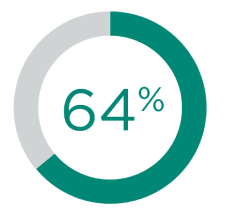

- 64% of people receiving care at home get their care solely from unpaid help

- Cash indemnity LTC coverage could provide financial relief for caregivers

Who is providing home care?

- Who is providing home care?

- Meeting the challenge

- Cash indemnity: Value vs. price

America is facing a crisis. As baby boomers age into retirement, the demand for senior services and long-term care (LTC) supports continues to grow. So far, boomers are the largest population to retire, yet they face a unique challenge that past generations escaped: Who will be available to provide the care they may need?

Studies show that most people would prefer to receive LTC at home, especially post-pandemic.1 However, the number of people available to work for agencies that provide home health care (HHC) was barely growing prior to the pandemic and has been further impacted since. Long-term care employers will need to fill an estimated 8.9 million direct care job openings by 2032 to accommodate the demand.2 To make matters worse, turnover rates in the home care industry are high, exceeding 64%.3 Therefore, the HHC industry is bracing itself for a labor shortage and the challenge to fill these much-needed caregiving positions.

This situation could increase the need for informal caregivers to step in and provide care to help prevent an individual from being forced into a facility simply because professional care services at home were not readily available. However, the people charged with these tasks may not be financially able to reduce their working hours or step away from their job.

Who is providing home care?

of people receiving care at home get their care solely from unpaid help4

receive some combination of family care and paid help4

receive all their care from paid help4

What is an informal caregiver?

Simply put, an informal caregiver is an unpaid individual — usually a spouse or partner, family member, friend or neighbor — who assists an individual requiring help with activities of daily living (ADLs) or other living needs. Some of these tasks may be what are called instrumental activities of daily living (iADLs). This care usually takes place in a home setting. 25% of informal caregivers are millennials, who may pay a price for caregiving. They are more likely than older caregivers to be warned by their employer about performance and attendance, be turned down for promotions or get fired. This results in the risk of lower lifetime wealth, retirement savings and Social Security benefits.5 The resulting cost in cash and lost opportunities to people providing informal care is more than double the paid cost of home health care and facility care combined:

- $475 billion = annual cost of paid care at home, community or in a facility6

- $600 billion = annual cost resulting from people providing informal care7

To put these numbers in perspective, the cost of informal care is greater than Walmart’s 2023 revenue, which totaled $611 billion.8

Economic impact to caregivers

People may perceive informal care as being free, but there is an economic cost to family and friends who make sacrifices to provide the care. The average caregiver is a 50-year-old female. 71% of caregivers under age 65 are also employed. 48% of these caregivers are caring for a parent, 11% care for a spouse/partner, and 10% for grandparents. They spend 20+ hours a week providing care in addition to working.9 Caregiving reduces paid work hours for these women on average by 41% and results in other career sacrifices such as passed-up promotions, taking a leave of absence, quitting their job entirely or retiring early.9 Individuals who return to work when caregiving ends often end up in a job that pays less and offers fewer benefits than their previous job.9

To add to the economic sacrifice, nearly half of the caregivers report having out-of-pocket financial impact as a result of caregiving10:

- 28% stopped saving

- 23% took on more debt

- 22% used up short-term savings

- 19% left bills unpaid or paid them late

Activities of daily living12

- Bathing

- Dressing

- Eating

- Transferring

- Toileting

- Continence

Instrumental activities of daily living

- Household chores

- Meal preparation

- Managing money/paying bills

- Transportation

- Shopping

Time spent caregiving

Caregivers often invest a significant amount of time into helping their loved one. This results in time away from their own family members, friends and personal and work responsibilities. While they understand the importance of the care they provide, half of caregivers report they had no choice in taking on the caregiver role.

Health impact on caregivers

Economic, time, physical and emotional challenges associated with caregiving can impact the health of the caregiver.9 In fact, informal caregivers are more susceptible to:

- Emotional stress

- Anger and anxiety

- Substance abuse

- Higher mortality rate

Meeting the challenge

How can financial professionals help clients address some of these challenges? That’s where long-term care insurance coverage may help. Any type of LTC coverage can provide additional funds to help cover the cost of qualifying LTC expenses. This provides an individual with more care options beyond depending on family or friends.

However, when discussing LTC coverage with a client, the financial professional should ask what type of care is desired. Clients who express an interest in paying family members or unlicensed caregivers, or who are looking at alternative care services for their LTC needs, may want to consider a cash indemnity policy.

Cash indemnity: Value vs. price

When considering the available policies, how do you determine which one is worth more? On one hand, a reimbursement policy has more potential benefit dollars, but it reimburses only the actual cost of care covered under the policy provisions up to the benefit amount. A reimbursement policy may not pay for less expensive unlicensed caregivers and certain types of alternative care. And it either limits or does not reimburse payments made to an immediate family member to provide care. But a reimbursement plan may be a better choice when there are concerns about wasteful spending.

On the other hand, cash indemnity LTC benefits pay the full available monthly benefit and can be used 100% without restriction from the insurance company. That includes using LTC benefits to pay a family member or friend to provide the care. This could help replace some or all of the income the caregiver may have to sacrifice when taking on the caregiving responsibilities.16

There is also a future value to cash indemnity benefits in that they can be used to pay for the unknown. As other creative solutions to LTC services and supports — such as robots — become available, cash indemnity benefits can be used to pay for whatever is needed. Therefore, some clients may find more value in a policy with a benefit pool that is open to any care option — without the need for approval from the insurance company. As this shift in the LTC workforce takes place, it’s likely that LTC services and supports will continue to evolve to meet the ever-changing needs people will face. Owning cash indemnity LTC coverage is one way to prepare for those changes as it provides flexible funding to pay for family care.

Related topics & resources

Older couple walking through forest together

Nationwide CareMatters®

This single-life coverage is for clients who are primarily looking for long-term care coverage and want to be able to recover their costs if they never need care.

[1] “The Nationwide Retirement Institute® 2024 Long-Term Care Consumer Survey,” conducted by The Harris Poll (November 2021).

[2] Direct Care Workers in the United States: Key Facts 2024 – PHI Policy Research Report, Sept. 2, 2024

[3] “HHAeXchange’s Homecare Predictions for 2022,” the HHAeXchange Leadership Team (February 4, 2022).

[4] “Caregiving in the U.S. 2020,” AARP and the National Alliance for Caregiving (May 2020).

[5] Electronic Caregiver: “Millennials, the Next Generation of Caregivers”- June 20, 2022.

[6] Kaiser Family Foundation “10 Things About Long-term Care Services and Supports” – July 8, 2024.

[7] Family caregivers’ unpaid work valued at $600 billion: report” – McKnights Senior Living, March 9, 2023, Kathleen Steele Gaivin

[8] "Revenue of Walmart worldwide from fiscal year 2012 to 2024," T. Ozbun, statista.com/statistics/555334/total-revenue-of-walmart-worldwide/ (March 28, 2024).

[9] A Place for Mom “Caregiver Statistics: A Data Portrait of Family Caregiving” – Claire Samuels, June 15, 2023.

[10] “Reducing Costs for Families and States by Increasing Access to Home and CommunityBased Services,” Joseph Caldwell (March 2022).

[11] Kiplinger: “The High Cost of Senior Caregiving”- Ella Vincent, August 3, 2023.

[12] Internal Revenue Code Section 7702B(c)(2)(B).

[13] “Taking Care of Caregivers,” Drs. Elise Herman and Rashmi Parmar, Psychiatric Times (Feb. 7, 2022).

[14] “Standing Up and Stepping In” A Modern Look at Caregivers in the US - Guardian 2023 Study

[15] "More Americans than ever serving as caregivers for ailing, aging loved ones” – WCVB5 Boston, Feb. 17, 2023.

Please consult your tax advisor when paying an informal caregiver as there may be tax implications to such an arrangement.