Loading...

Medicare premiums increase in 2026: How to help your clients’ planning

Key takeaways

- Significant price increases are coming to Medicare in 2026 and probably in the years to come

- Clients want a financial professional with Medicare expertise1

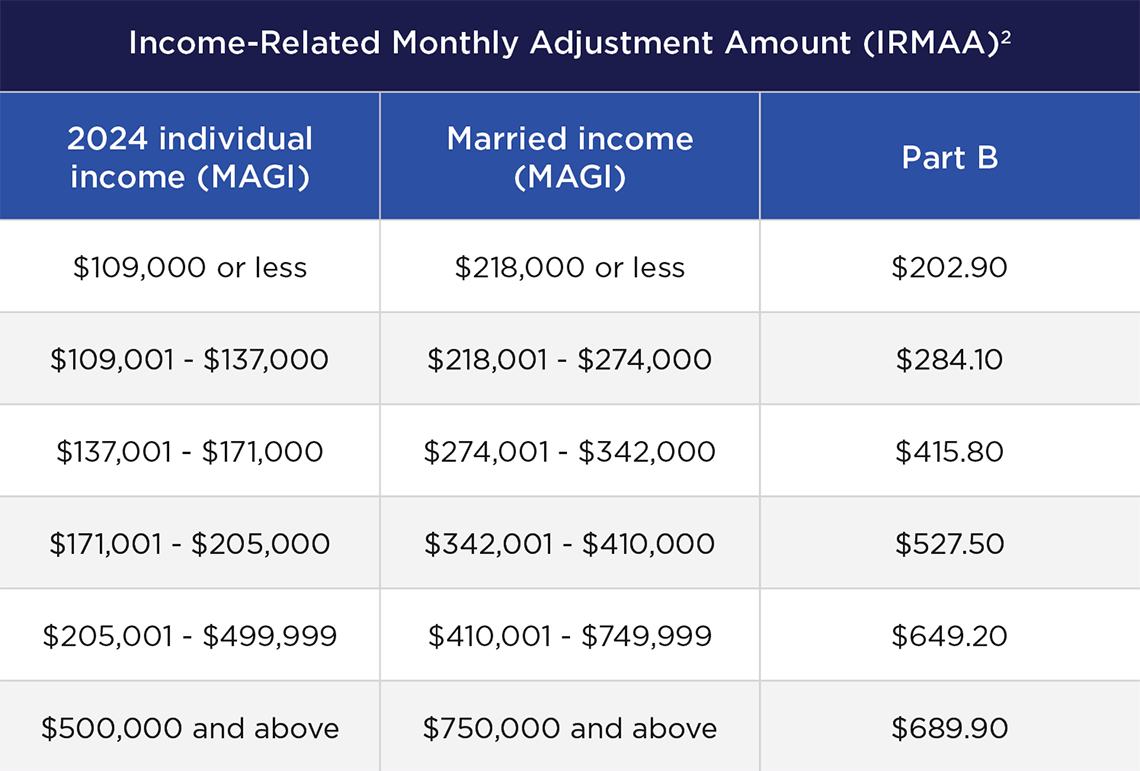

- Tax planning is key, as IRMAA surcharges (income-related monthly adjustment amount) remain an important consideration for higher-income clients

- Proactive planning can help clients manage health care costs and protect their retirement lifestyle

- Medicare Part B

- Medicare Part D

- Medicare Advantage

- Impact on retirement budgets

Health care is one of the largest and most unpredictable expenses in retirement, with Medicare premiums that include prescription drug coverage one of the biggest costs. In 2026, Medicare will see one of the steepest Part B premium increases in recent years, along with higher deductibles and higher premiums for prescription drug coverage. This means that this year, your guidance as a financial professional is needed more than ever.

Let's look at the Medicare changes for 2026 and how you can help your clients prepare for them.

Medicare Part B premiums for 2026

Part B covers doctor visits, outpatient services and many preventive care benefits. In 2026, both premiums and deductibles will rise sharply.

- Premiums: The standard monthly premium increases 9.7% to $202.90. That’s the largest dollar jump since 2022. For many clients, this will mean an additional $214 per year ($428 for couples) for Part B coverage alone.2

- Deductible: The annual deductible will rise from $257 in 2025 to $283 in 2026 — a 10% increase.2

This year’s increase is the latest in an ongoing trend of higher Part B premiums. From 2020 to 2026, premiums spiked more than 40%.3 According to the 2025 Medicare Trustees Report, Medicare beneficiaries will continue to see increases in Medicare Part B premiums over the next 9 years, making Medicare an essential part of your clients’ financial plans — not just this year, but for many years to come.

Finally, keep in mind that higher-income individuals must pay the income-related monthly adjustment amount (IRMAA), which is a surcharge to their Part B premium. In 2026, a couple who earned between $342,001 and $410,000 in 2024 will pay an additional $527.50 per month for their Part B premium.2

Medicare Part D cost changes for 2026

Part D covers prescription drugs through private plans approved by Medicare. Considering that 87% of people ages 65 to 74 use prescription drugs, this is a key cost to watch for retirement planning.4

In 2026, Medicare beneficiaries will see a combination of higher costs and continued caps on prescription drug prices:

- Premiums: The national base beneficiary premium will increase 6%, from $36.78 in 2025 to $38.99 in 20262

- Deductible: The standard Part D deductible will increase from $590 in 2025 to $615 in 20262

- Out-of-pocket cap: The Inflation Reduction Act introduced a cap on annual out-of-pocket prescription drug costs. That limit, which took effect in 2025, will rise slightly in 2026 (from $2,000 to $2,100)2

- Insulin: The $35 monthly cap on insulin (or 25% of the negotiated price, whichever is lower) remains in place2

- Vaccines: Recommended adult vaccines, including shingles, pneumonia and flu, will continue to be available at no cost2

As with Part B, Part D costs are on a continuous upward trajectory. From 2023 to 2026, the national base beneficiary premium rose 19%.5 IRMAA also applies to the Part D premium for higher-income beneficiaries. In 2026, a couple who earned between $342,001 and $410,000 in 2024 will pay an additional $60.40 + premium per month for their Part D coverage.2

Medicare Advantage

Medicare Advantage plans vary by insurer and type of plan. For 2026, the Centers for Medicare & Medicaid Services (CMS) report that monthly premiums across Medicare Advantage plans will decrease from $16.40 to $14. However, enrollees may find higher pricing across many of the larger insurers’ plans.

CMS also projects that enrollment in Medicare Advantage will fall for the first time in two decades to 34 million from 35 million in 2025. Historically, half of enrollees leave their Medicare Advantage plans within 5 years. The top reasons for leaving, however, typically involve difficulty accessing care and dissatisfaction with care quality — not cost.

Medicare Advantage open enrollment is January 1 to March 31, 2026. During this time, individuals already enrolled in a Medicare Advantage plan can switch to a different Medicare Advantage plan or return to Original Medicare and enroll in a separate Part D drug plan. However, switching from Medicare Advantage to Original Medicare could result in being denied Medigap coverage (or effectively denied by being priced out), meaning a Medigap insurer can deny coverage or charge higher premiums based on pre-existing conditions and medical underwriting. This would have the effect of making the switch back to Original Medicare not financially feasible.

How higher Medicare costs impact retirement budgets

Rising Medicare costs can have a ripple effect across every part of a client’s retirement plan. Even modest annual increases can translate into meaningful lifestyle adjustments over time. Taken together, Medicare cost increases can:

- Reduce discretionary spending: As more income goes toward health care, less may be available for travel, leisure or family gifting; clients may need to reassess spending priorities and adjust lifestyle expectations to maintain financial stability

- Put pressure on fixed incomes: Retirees who rely primarily on Social Security or fixed pensions may feel an even greater squeeze because higher premiums and deductibles have outpaced Social Security’s yearly cost-of-living adjustments (COLA), eroding purchasing power year after year; this will probably continue in 2026, when the nearly 10% increase for Medicare Part B premiums will far outpace the 2.8% COLA for Social Security

- Increase tax exposure: For higher-income retirees, IRMAA surcharges can add hundreds of dollars per month to Medicare premiums; strategic income planning — such as when to take withdrawals or complete Roth conversions — can help reduce exposure and preserve more of what clients have saved

- Amplify long-term inflation risk: Health care inflation has historically risen faster than general inflation; to avoid underfunding, it’s important to model annual increases of 5% to 6% for health care costs rather than relying on general inflation assumptions

Planning strategies for financial professionals

Your role in guiding clients through Medicare’s complexities is more important than ever. By taking proactive steps, you can help them avoid surprise expenses and make informed choices that preserve their retirement security.

Consider the following strategies:

Help clients plan with confidence

Medicare is one of the biggest drivers of your clients’ long-term costs during retirement. With premiums and deductibles heading higher in 2026, the stakes are rising for retirees who want to protect their lifestyle and preserve their savings.

Your guidance can make the difference between a post-retirement financial plan that strains under unexpected health care expenses and one that adapts smoothly. By helping clients understand what’s changing, modeling the impact on their budgets and building strategies to manage costs, you show the real value of working with a financial professional who looks at the whole retirement picture.

Person in an orange sweater stands in a bright kitchen, leaning on a counter with a teacup and saucer near a stovetop.

[1] The 2025 Nationwide Retirement Institute Health Care Costs in Retirement Survey.

[2] Centers for Medicare & Medicaid Services, cms.gov/newsroom/fact-sheets/2026-medicare-parts-b-premiums-and-deductibles (Nov. 14, 2025).

[3] “A look at Medicare Part B’s premium increase history,” Medical News Today, Faye Stewart, https://www.medicalnewstoday.com/articles/medicare-part-b-premium-increase-history (Sept. 30, 2025).

[4] “9 in 10 Older Adults Rely on Prescription Medications,” AARP, https://www.aarp.org/health/drugs-supplements/more-older-adults-need-prescriptions (May 13, 2025).

[5] “Part D / Prescription Drug Benefits,” Center for Medicare Advocacy, https://medicareadvocacy.org/medicare-info/medicare-part-d (accessed Oct. 10, 2025).

Federal income tax laws are complex and subject to change. The information in this memorandum is based on current interpretations of the law and is not guaranteed.

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.