Loading...

A strategy for efficiently passing along IRA assets

Key takeaways

An idea for investors who must receive required minimum distributions (RMDs) from assets in traditional IRAs and want to preserve excess IRA assets for their heirs

This approach allows individuals to more efficiently leave IRA money behind to their spouse, children or other beneficiaries

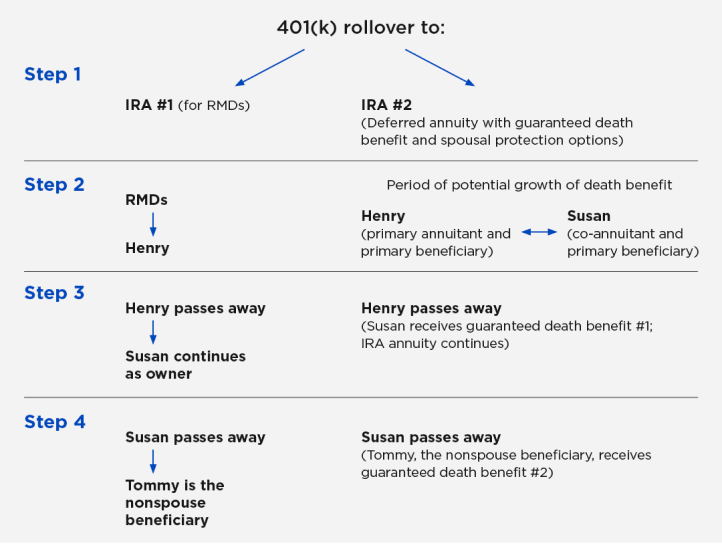

It’s a two-IRA strategy, in which one IRA is used for RMDs, and the other is a deferred annuity with a guaranteed death benefit

When the goal is to make legacy planning of IRA money as effective as possible, dividing those funds into two IRAs might be a smart solution. The target audience for this concept is a client who wants to preserve some of their IRA assets for their spouse and/or child(ren).

The idea is to have one IRA for RMDs and the other IRA invested in a deferred annuity with a guaranteed death benefit. The first IRA will be funded with enough assets to cover future RMDs for both IRAs. The second IRA will remain untouched for as long as possible to allow the annuity’s guaranteed death benefit amount to grow without being reduced by distributions.

To make it possible to enhance this strategy by using a spousal protection feature, both spouses must be co-annuitants and primary beneficiaries. Then adding a spousal protection death benefit option can provide additional death benefit protection by covering both the IRA owner and the owner’s spouse. The contract value is increased to the guaranteed death benefit value upon the death of the IRA owner and/or the owner’s spouse, depending on the product. The surviving spouse also gains liquidity because any remaining surrender charges are waived after processing the first death benefit.

You may know that owner-driven annuity products can offer similar spousal protection features on nonqualified deferred annuities by naming both spouses as joint owners. However, with IRA annuities, joint ownership is not permitted. But an annuitant-driven contract, such as many of Nationwide’s annuity contracts, can offer death benefit protection for both spouses. In this IRA annuity strategy, both spouses serve as co-annuitants, so the payment of a death benefit is triggered upon the death of either spouse.

An example

Upon his retirement, Henry rolled over $500,000 from his qualified plan into a traditional IRA and named his wife, Susan, the primary beneficiary. Henry wants to know that if he passes before Susan, she will receive the maximum amount of his IRA assets. After consulting with his financial advisor, Henry splits his IRA into two IRAs: one to cover RMDs and the other a Nationwide annuity with guaranteed death benefit and spousal protection features. Henry is owner and annuitant and Susan is named co-annuitant. Both Henry and Susan are named primary beneficiaries.

At age 73, Henry must begin taking required minimum distributions every year. The RMD amount for both of his IRAs will come from IRA #1, which was set up specifically for RMD withdrawals for as long as possible. As Henry is taking these RMDs year after year, the IRA #2 annuity guaranteed death benefit amount will remain untouched and may continue to grow.

If Henry passes away before Susan, she is allowed to continue both IRAs as her own and must take RMDs beginning at age 73. Susan will receive her RMDs from the remaining account balance of IRA #1. From IRA #2, Susan will receive the guaranteed death benefit. If she doesn’t take any distributions from IRA #2, the guaranteed death benefit will continue to grow for her beneficiary, their son, Tommy. Upon her death, Tommy will receive the remaining account value from IRA #1 and another guaranteed death benefit from the annuity in IRA #2.

How it works

Tax considerations

- RMDs must be taken by April 1 of the year after the IRA owner turns (75 if born in 1960 or thereafter) and must continue to be taken every year thereafter

- Cumulative RMD amounts calculated from all IRA funds may be taken from any single IRA or a combination of IRAs

- Clients can use a trustee-to-trustee transfer or rollover to split IRA funds into more than one account

- A direct trustee-to-trustee transfer should be used whenever possible

- Any RMD not taken in a timely manner is subject to a 25% tax penalty

Book time with our Retirement Institute Planning team or contact the team at nriplanning@nationwide.com.

Related topics & resources

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.