Loading...

Supporting charitable causes while protecting children’s inheritance

A charitable gifting plan can enable your clients to create a meaningful and lasting legacy as they make a significant contribution to their community and take advantage of financial benefits for themselves and their family members. For you, exploring charitable gifting options with clients can deepen your relationship with them as you lay the groundwork for business relationships with their heirs.

What gifting options are available?

There are many strategies for charitable gifting, each generally offering tax benefits to the person making the gift. Those benefits vary based on the nature of the asset gifted and the strategy used. The many ways to execute on charitable intent include, but are not limited to:

- Outright donations of money or assets

- Life insurance legacies

- Charitable gift strategies

- Qualified charitable distributions

- Charitable trusts

- Donor-advised funds

- Charitable bequests

- Various other arrangements

What are the benefits and how does it work?

When a client chooses to support a nonprofit organization through charitable giving, they invest in and enrich the lives of those whom the organization seeks to help. In turn, your client can benefit as well. Some potential tax benefits of charitable gifting can include:

- A significant current income tax deduction

- A reduction of taxes associated with required minimum distributions

- A reduction in the size of their taxable estate

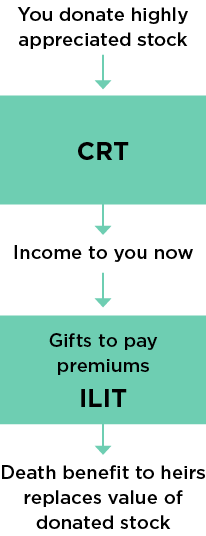

Consider this example: Let’s say your client wants to support their favorite charity with a charitable remainder trust (CRT). They can set up the trust and fund it with a large contribution of highly appreciated stock, thereby avoiding capital gains taxes and getting a nice income tax deduction as well. The CRT can be set up to pay income for the rest of their life, leaving the balance to charity when they pass away.

What about the children?

When considering support for charity, one potential issue arises regarding its impact on the inheritance of the clients’ children. After all, if they make large donations to charity, there will be less to pass on to heirs.

By proactively planning to replace the value of their donation, they can skirt this issue with an irrevocable life insurance trust (ILIT) — a wealth replacement trust.

They use the income from the CRT to make gifts to the ILIT, which can then purchase a life insurance policy on them.

When they pass away, the tax-free death benefit will pay into the trust. The trust will then distribute the tax-free death benefit to their heirs.

Additionally, they can use the trust to control the distribution of the death benefit through restricted beneficiary designations. This can be a useful consideration when heirs may be too young or immature to handle a lump-sum inheritance.

Nationwide offers a wide range of materials to help you simplify the complexities of charitable gifting and other legacy, estate and wealth transfer topics.

This information is general in nature and is not intended to be tax, legal or other professional advice. Federal income tax laws are complex and subject to change. The information presented here is based on current interpretations of the law and is not guaranteed.

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.