Loading...

Estate equalization for high net worth clients

Key highlights

- This strategy enables a high net worth client to treat all of their heirs equitably when some heirs will receive assets worth more than other heirs, such as a business with a value that is the majority of the estate.

- An irrevocable life insurance trust (ILIT) frequently is an important wealth transfer strategy for affluent clients. By purchasing life insurance in an ILIT, the death benefits will not be included in the client's estate for federal estate tax purposes.

- Clients who want to extend their financial legacy after their death may also consider purchasing a nonqualified deferred annuity that a nonspouse beneficiary can stretch over their life expectancy.

Life insurance death proceeds can be used to equalize an estate that has highly valuable and/or hard-to-divide assets.

High net worth clients may possess assets that would need to pass equally to all heirs or be sold in order for the client's total estate to pass to all heirs equally. These assets could be things such as a valuable family heirloom, a closely held business, or real estate that the client wants to leave to a particular heir(s) instead of all heirs equally. A client in this position may want a solution that equalizes their estate without resorting to leaving those assets to all heirs equally or selling them.

Avoiding estate tax may also be a goal for high net worth clients. You can address both needs with life insurance owned by an irrevocable life insurance trust (ILIT).

An example

Ruth, 67, is a recent widow. Ruth has a sizable estate and is concerned about federal estate and other inheritance taxes. She and her husband raised 3 children in an elegant family home on the East Coast. Rachel, 43 and the oldest of her children, is single with a successful career in Chicago. She is settled into her life and has no desire to move back east. Brenda, 41, is the middle child and is married to Adam. Together with their 3 children, they live close to Ruth in what they like to call their “forever home.” Dan, 38, is the youngest, and he also lives close to his mother. Dan studied hospitality in college and works at a nearby hotel that is quite popular with tourists. He has expressed his desire to someday convert his parents’ home into a bed-and-breakfast. He is married to an interior designer and feels confident that the mix of his hospitality skills and his spouse’s good taste would help them create a successful and inviting business.

Ruth loves Dan’s enthusiasm for keeping the house in the family and converting it into a bed-and-breakfast. She plans to leave the property to him, but the value of the family home is more than 50% of the value of her total estate.

Estate equalization steps

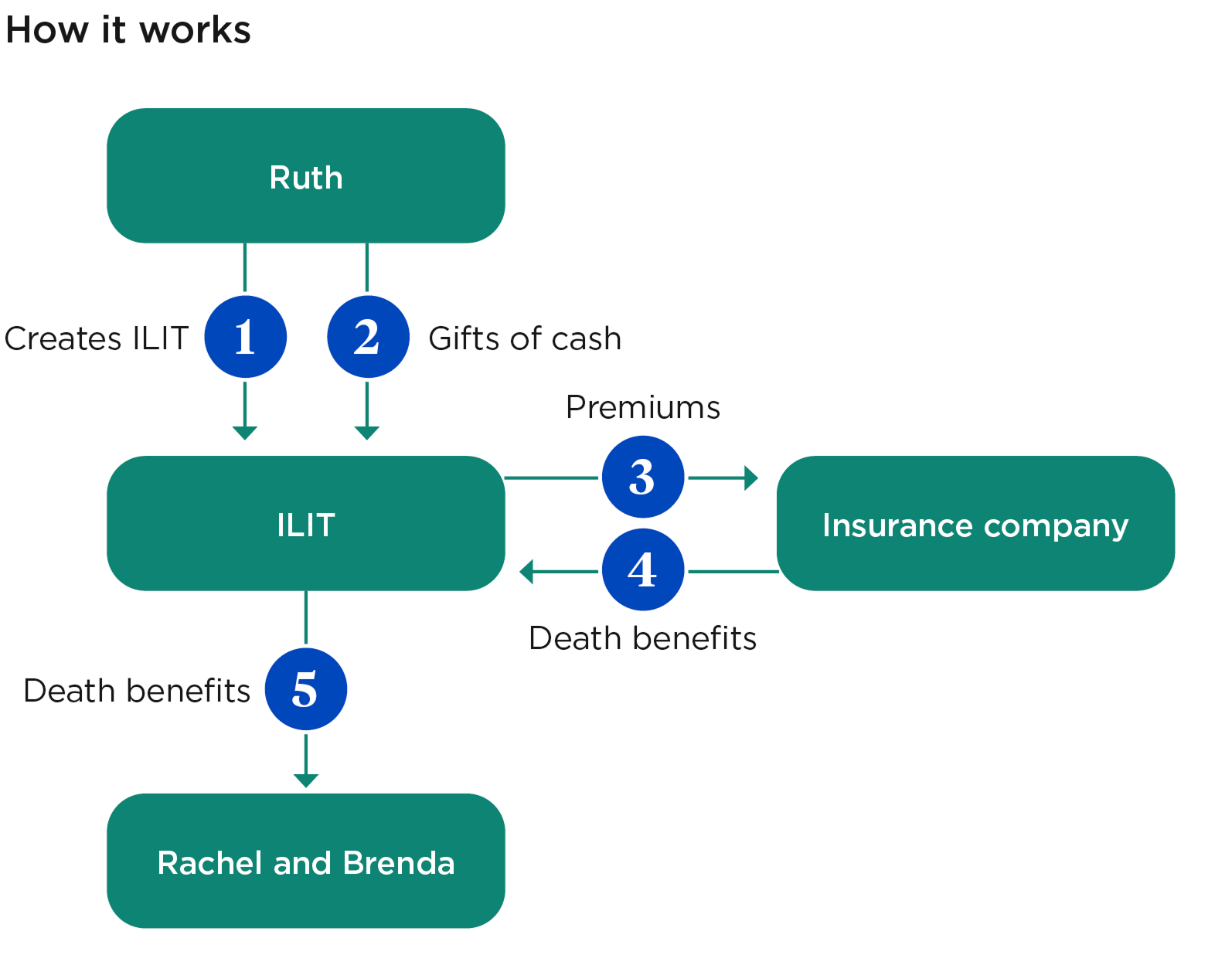

- Ruth sets up an ILIT with Rachel and Brenda as trust beneficiaries and makes cash gifts to the trust.

- The ILIT purchases life insurance on Ruth's life such that the trust receives the death proceeds at Ruth's death to pay to Rachel and Brenda, which creates equity in the overall distribution of the estate.

- The premium payments paid by the ILIT are not deductible, but when Ruth passes away the death proceeds paid to Rachel and Brenda are generally income tax free.

Cautions

If properly drafted, an ILIT can allow the trustee access to the accumulated cash value of the life insurance policy by taking loans on the cash value earnings and/or distributions of the cost basis — even while the insured is alive. If, however, the death proceeds remain in the trust after the death benefit has been paid, any investment income that is earned and not distributed to the beneficiaries may potentially be taxed at higher trust tax rates.

An ILIT is an irrevocable trust, which generally means no changes can be made once the trust is finalized. As a general rule, whatever is put into the trust is no longer accessible, and this could have serious implications if circumstances change. For example, if a grantor puts a house or a significant amount of cash in the trust with the intent that it will be given to their heir, and then the grantor unexpectedly needs those assets in the future, the grantor generally cannot obtain them. In some cases, an irrevocable trust can be dissolved, redacted or decanted into a new trust if allowed under state law. Refer clients to a trust attorney in their state of residence.

For

more information or answers to questions on the estate equalization strategy and ILITs, financial professionals can contact the Advanced Consulting Group at 614-677-6500 or

ADVCG@nationwide.com.