Loading...

It’s time to have legacy planning conversations with your clients.

Why is legacy planning important?

There’s a huge intergenerational wealth transfer on the horizon, and it’s important to plan ahead. Without taking the initiative to discuss legacy planning with clients, financial professionals are at risk of losing assets under management.

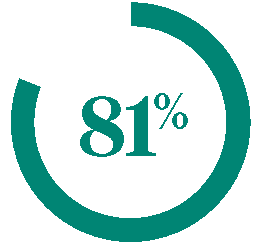

of affluent investors report not using their parents' financial professional.1

of women switch their wealth relationship to a new financial institution within a year of their spouse's death.2

High net worth individuals seek more guidance on the following legacy planning topics with financial professionals3:

Enhancing the level of client trust in your relationships can set you up for successful legacy planning conversations. An important pathway to building trust is empathy.

Legacy Planning with compassion

Trust is the foundation of any strong financial planning relationship. It's what drives client satisfaction, loyalty, and long-term engagement—the key ingredients for referrals and a successful practice.3

“Performing empathy” drives greater trust among your clients and can make the difference for your business. Performing empathy is key to:

- Enhancing client trust

- Deepening client relationships

- Retaining clients and assets

- Differentiating yourself within an increasingly commoditized industry

The Nationwide Retirement Institute®

supports you as you work with clients on estate planning.

We have extensive resources available to help you respond with a deeper understanding of client wishes and family dynamics. We can help you with topics such as Aging with dignity and Bridging generations through estate planning.

Aging with dignity

You have unique insights into the understanding of your clients’ goals and objectives. You’ve helped your clients prepare for retirement, and it is a logical extension to help them plan for aging. Practicing empathy can help you get to a point where you can say confidently to clients:

“I see and understand how you see the world.”

“I see and understand who you are.”

“I see and understand who you want to be.”

This may sound like:

“Is it important to you that your children keep the family home?”

OR

“How do you want to address your personal care needs?”

Bridging generations through estate planning

What is estate planning?

Estate planning is the distribution of a client’s assets via wills, trusts and other means to reduce costs and tax liabilities while respecting the client’s wishes.

By leading with empathy, addressing aging and helping clients plan for their estates, you can help bridge generations. It gives you the opportunity to maintain current business or even expand your business to the next generation.

Learn more about legacy planning.

[1] The Cerulli Edge -- U.S. Retail Investor Edition, (4Q 2023)

[2] "The wealth transfer from baby boomers mostly benefits women," The Washington Post, www.washingtonpost.com/business/2024/01/16/women-economic-power-demographic-shifts/ (January 16, 2024)

[3] 2024 Bank of America Private Bank Study of wealthy Americans, https://ustrustaem.fs.ml.com/content/dam/ust/articles/pdf/2024BoA-PB_Study_of_Wealthy_Americans.pdf (February 2024)

Related topics & resources

Older couple walking through forest together

Nationwide CareMatters®

This single-life coverage is for clients who are primarily looking for long-term care coverage and want to be able to recover their costs if they never need care.

Nationwide CareMatters is a service mark of Nationwide Mutual Insurance Company.