ESTATE PLANNING & WEALTH TRANSFER

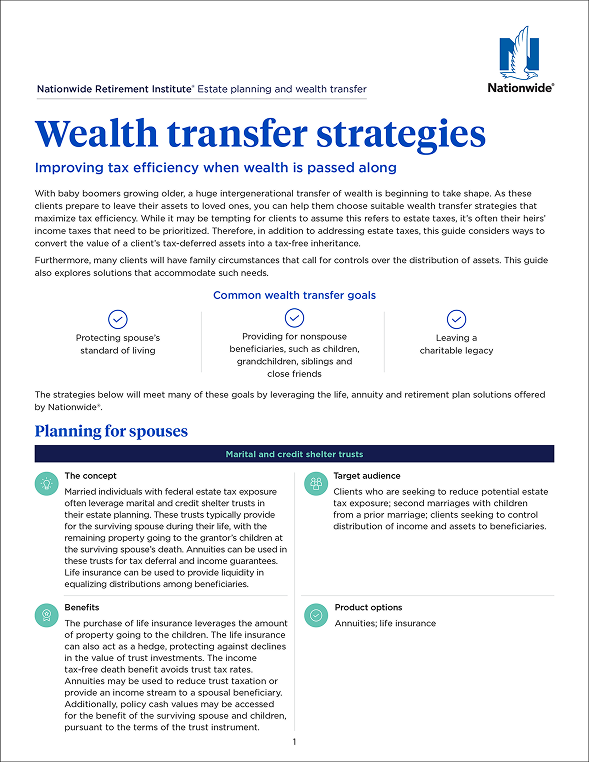

Wealth transfer strategies

Key takeaways

Summary

We’re here to help

Questions about complex planning strategies? Contact your Nationwide wholesaler or the Nationwide Retirement Institute Advanced Consulting Group at advcg@nationwide.com.