Loading...

White paper summary: Guaranteed retirement income boosts retirement satisfaction

A research-based investigation of the role for annuities and in-plan guarantees

Wade D. Pfau, Ph.D., CFA®, RICP®, Professor of Practice, The American College of Financial Services

Michael Finke, Ph.D., CFP®, Professor of Wealth Management, The American College of Financial Services

Download full article

Key takeaways

- Both longevity and unpredictable markets can wreak havoc on a retiree’s ability to stretch their retirement savings for a lifetime

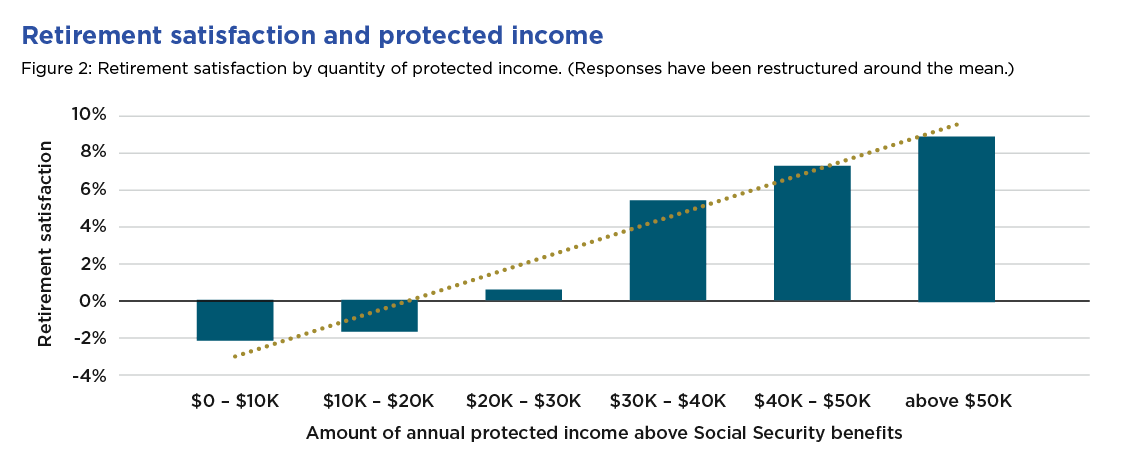

- Retirement satisfaction is shown to increase with higher levels of guaranteed income

- Many options allow for integration of protected retirement income into planning scenarios

- The remainder of the portfolio can be reallocated to stay ahead of inflation

Executive summary

Creating an income from savings in retirement is complicated by two important sources of uncertainty: Investment returns could be lower than expected, and one could end up living longer than planned. Longevity and unpredictable markets can wreak havoc on a retiree’s ability to stretch their retirement savings for a lifetime. Today’s retiree must find a way to turn savings into income to fund more years of spending on average than previous generations, and they must do this while starting with fewer sources of protected, lifelong income.

Annuities and in-plan guarantees give retirees the opportunity to invest in protected lifetime income, backed by an insurance company, to reduce the risk of unknown longevity and poor investment returns. An approach that combines protected lifetime income sources and investments can help a retiree meet spending goals more efficiently than an investments-only approach — both from a financial and an emotional perspective. Protected income allows retirees to spend more and worry less.

Research using data collected by the University of Michigan's Health and Retirement Survey1 shows that today’s retirees who have more lifetime income are more satisfied with their retirement. As the amount of protected income rises, so does retirement satisfaction even among those who have a higher net worth and among older retirees. The stability and security of guaranteed income helps retirees worry less about the consequences of ups and downs in the market. The assurance of income that won’t run out in old age can also give retirees the confidence to spend more on things they enjoy, even after a market loss. Annuities and/or in-plan guarantees must be treated as essential tools in the retirement planning toolkit.

The addition of protected lifetime income investments to a retirement portfolio allows a retiree to get the same or higher income with less risk of outliving savings than an investments-only approach. These allocations allow a retiree to spend at a level that investments alone would be unable to match without significant risk of running out of money before age 95. Blending protected income and investments can also enhance the legacy value of assets over the long term.

For retirees, it’s about more than money. Not only do these added protections provide income that can’t be outlived, they offer confidence and more financial security — something you can’t put a price tag on.

Access the full version of the white paper for three case studies you can follow to help improve satisfaction with your retiring clients.

Retirees who have more protected income are more satisfied with their retirement. Even at the highest levels of net worth, retirees with more protected income were significantly more satisfied.

[1] ”The Health and Retirement Study," hrs.isr.umich.edu (2020).

The white paper referenced in this summary was sponsored by Nationwide and is the proprietary property of The American College of Financial Services. It may not be reproduced, in whole or in part, in any manner, without the prior written consent of The American College of Financial Services. The American College of Financial Services and its affiliates are not related to Nationwide and its affiliates.

The Health and Retirement Study (HRS) is sponsored by the National Institute on Aging (grant number NIA U01AG009740) and is conducted by the University of Michigan.

Nationwide does not control any third-party presenting information and is not responsible for their comments. Sponsorship of a third party does not imply endorsement of the information presented. Views and opinions are those of the speaker and do not necessarily represent the opinions of Nationwide.

When evaluating the purchase of an annuity, your clients should be aware that annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Please read the contract for complete details. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% early withdrawal federal tax penalty.

Related topics & resources