Minimizing taxes on Social Security benefits

Key highlights

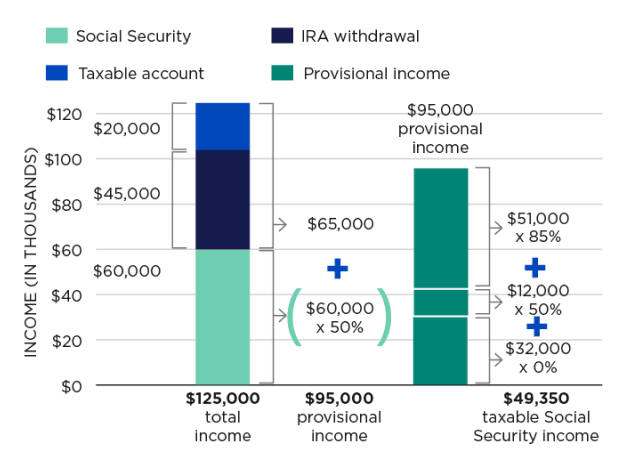

Couple 1

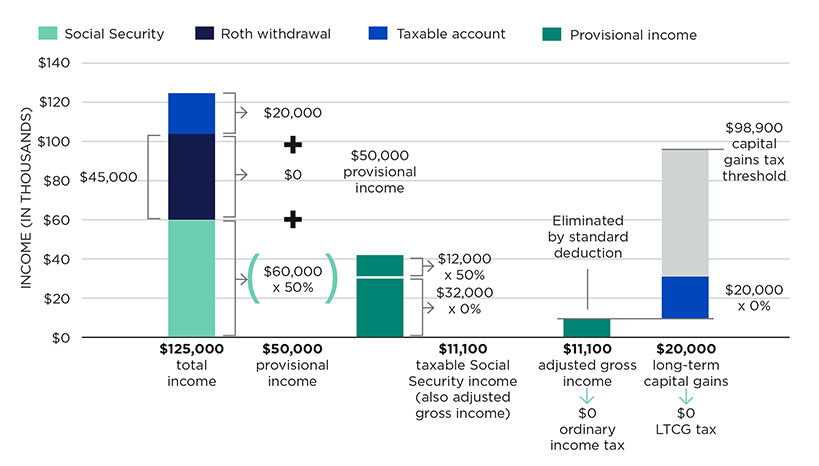

Couple 2

A Roth IRA conversion allows your clients to move money from a traditional IRA into a Roth IRA. While the conversion itself is a taxable event, future withdrawals from the Roth IRA in retirement are tax-free and don’t contribute to Social Security provisional income.

By carefully balancing withdrawals from taxable accounts, such as brokerage accounts, and tax-deferred accounts, such as traditional IRAs and 401(k) accounts, you can manage your client’s adjusted gross income to keep it below the threshold at which Social Security benefits would be taxed.

HSAs can provide a triple tax benefit. Contributions are tax deductible, growth is tax free, and withdrawals for qualified medical expenses are tax free. After age 65, HSA funds can be withdrawn for any reason without penalty, although income tax applies to nonmedical withdrawals. Importantly, tax free withdrawals don’t count toward provisional income.

Encourage clients to invest in tax-efficient strategies such as cash value life insurance or using index funds, ETFs or tax-managed funds in taxable brokerage accounts. These can help provide income that is either not taxed or taxed at reduced rates, keeping the client’s overall income lower and potentially reducing taxes on Social Security benefits.

For clients who have other income sources, delaying Social Security benefits can sometimes result in larger levels of lifetime benefits and lower overall taxable income earlier in retirement. However, the decision to delay benefits should be balanced against the client’s overall financial picture and life expectancy.

For clients who are charitably inclined, qualified charitable distributions (QCDs) from an IRA can satisfy required minimum distributions (RMDs) while excluding the distribution from income, potentially reducing the tax on Social Security benefits.