Loading...

Help clients with retirement age expectations

Aligning retirement age with retirement readiness

Key insights from my white paper "Navigating critical decisions in developing a retirement income plan"

Steve Vernon, FSA®, President, Rest-of-Life Communications

Key takeaways

- Clients often lack clarity on how much income their savings will support; identifying this early allows you to help them adjust plans and reduce the risk of outliving assets

- Delaying or phasing into retirement can help increase retirement account balances, maximize Social Security benefits and preserve more savings

- Guaranteed income solutions can provide a way to better cover essential expenses and reduce stress tied to market volatility and longevity risk

Many clients have a clear vision of when and how they want to retire. But that vision doesn’t always align with their financial reality. When a client’s desired retirement age doesn’t match up with the reality of what their projected savings can safely support throughout retirement, a disconnect can emerge. For financial professionals, helping clients recognize and address this gap is key to ensuring that they can maintain their preferred lifestyle without sacrificing long-term financial security.

Identify the income gap

A working client may assume that retiring at age 62 or 65 is realistic based on their expectations or peers’ experiences. But once they see their projected level of savings at their desired retirement age and account for both likely spending levels in retirement (including out-of-pocket health care costs) and life expectancy, it may become clear that their assets are unlikely to stretch far enough. If this isn’t addressed, this disconnect can increase the risk of overspending, premature depletion of savings and financial strain later in life.

Encourage changes to help enhance income security

You can guide clients facing this shortfall through options to help close the gap. A couple of often-overlooked strategies include delaying retirement or phasing into retirement, both of which offer 3 distinct financial advantages:

1. They boost retirement income potential.

Working longer provides more time to contribute to retirement accounts and allows savings to grow. Even a few additional years can make a big difference in compounded investment returns and overall retirement readiness.

2. They eliminate the lifetime harm of filing for Social Security benefits early.

This increase is twofold. First, adding additional years of work may improve the earnings history that the Social Security Administration uses to calculate benefits (benefits are based on a worker’s highest 35 years of qualifying employment). Second, a delayed Social Security filing (beyond the earliest age they could file at 62) results in as much as 77% higher monthly benefits1 for the client and potentially for the surviving spouse. Filing early locks in lower benefits for life and reduces survivor benefits.

3. They reduce the chances of running out of money.

By postponing withdrawals from retirement savings, clients can preserve more of their portfolio, potentially ensuring longer-lasting support for a surviving spouse or leaving a larger financial legacy.

Job satisfaction may play an important role in the decision between a phased-in or delayed retirement. Clients who enjoy their careers may be more inclined to delay retirement entirely — continuing full time to boost savings and maximize Social Security benefits. On the other hand, clients who are open to a delayed retirement but want to quit a high-stress day job could consider employment with greater flexibility in their final working years. This can help boost their savings and delay or increase future Social Security benefits.

Build confidence (and income replacement rates) with guaranteed income

Whichever path your clients choose, you can help them feel more confident in the road ahead by incorporating guaranteed income sources such as annuities or in-plan lifetime income investment options. A stable, predictable stream of income can help cover essential living expenses, allowing clients to spend more freely with fewer worries about market volatility or longevity risk. This protection can be especially comforting for clients who may feel financially underprepared for retirement.

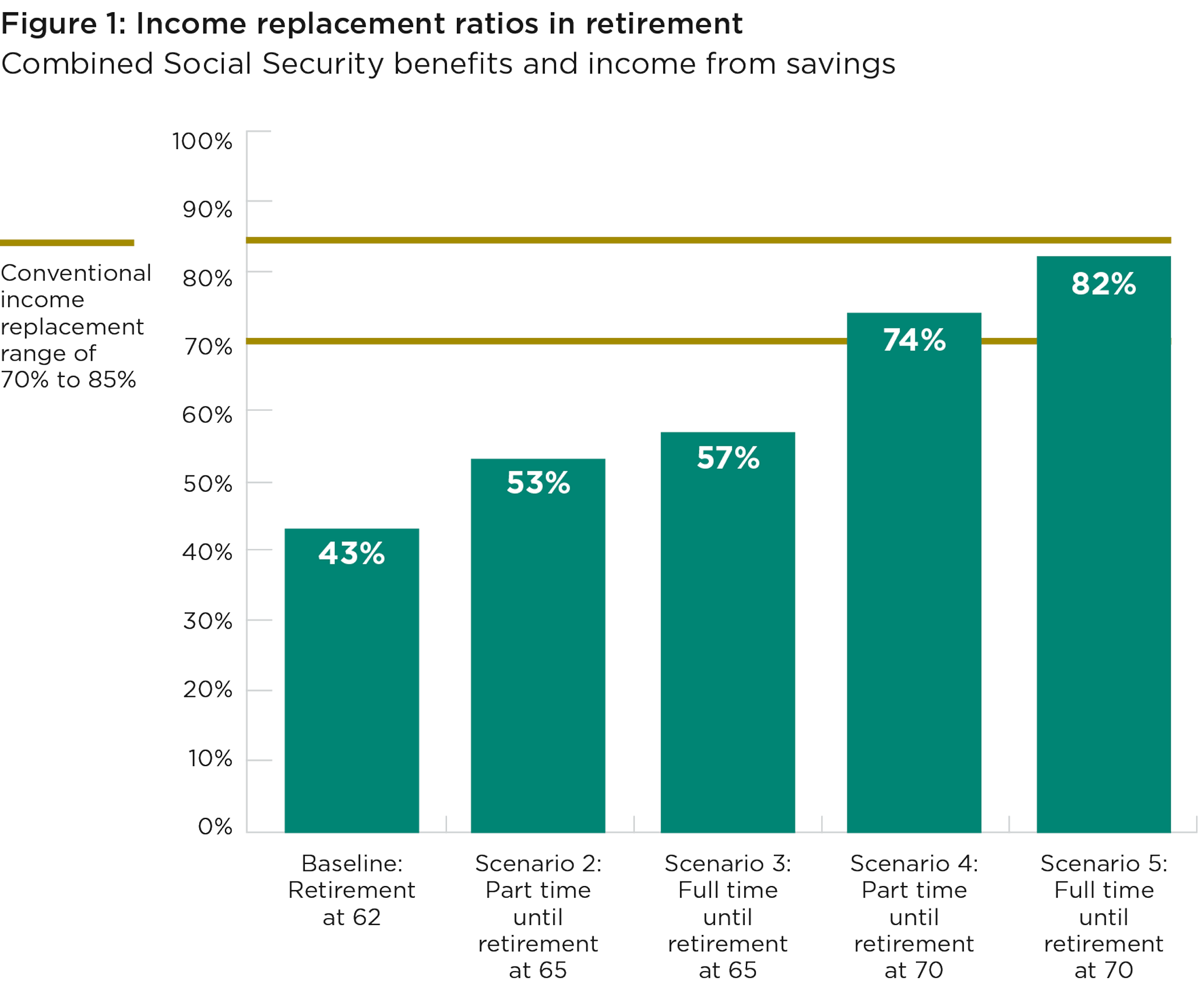

How much can a delayed or phased-in retirement help? The chart shown in Figure 1 highlights the potential difference that both options could make in working toward a 70% to 80% level of income replacement, which is typically most desired.

Help clients make informed retirement decisions

A personalized, thoughtful approach to planning can help pre-retirees align their retirement timing with their financial realities and personal goals. By helping clients make informed, intentional choices, you play a vital role in shaping a retirement strategy that supports long-term stability and confidence.

1 This 77% figure is based on an individual with a full retirement age (FRA) of 67, comparing early filing at age 62 and receiving reduced benefits of 70% of the FRA amount versus a delayed filing at age 70 and receiving credits equal to 124% of their FRA benefit.