Loading...

Shockproof retirees’ income plans

Helping clients plan ahead to avoid surprise expenses

Key insights from my white paper, “Navigating critical decisions in developing a retirement income plan”

Steve Vernon, FSA®, President, Rest-of-Life Communications

Download the full white paper

Key takeaways

- 30% Unexpected expenses, such as medical bills and long-term care, can significantly disrupt retirement income plans

- Unplanned withdrawals from tax-deferred accounts often result in higher taxes or Medicare surcharges

- Rising health care costs are a major challenge, requiring flexibility and diverse income sources to manage effectively

Some retirement expenses are expected. Others come as a surprise. And it’s those expenses, especially the big ones, that can throw a retirement income plan off course.

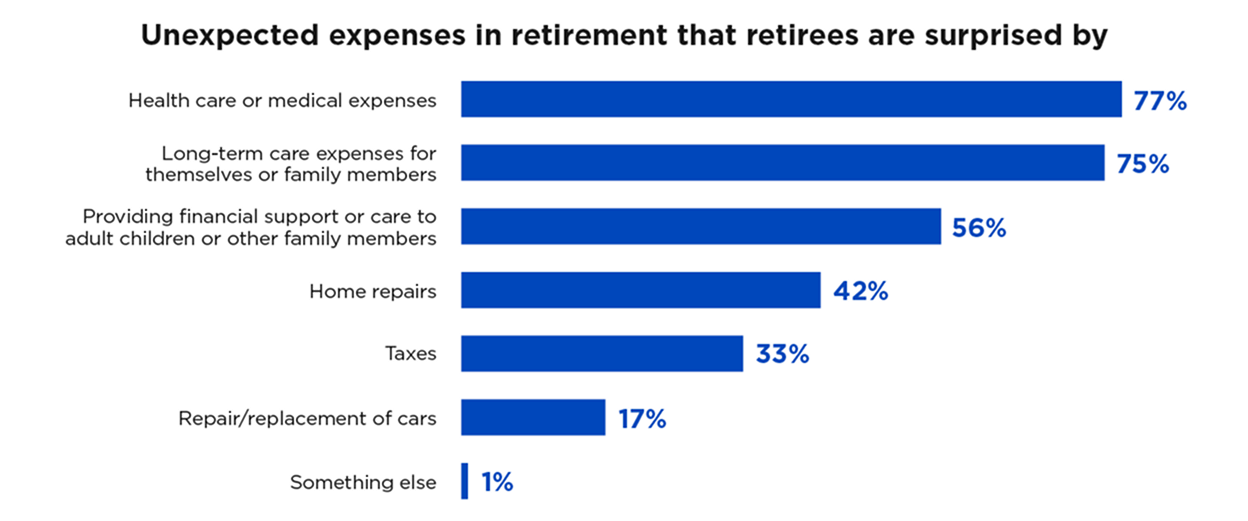

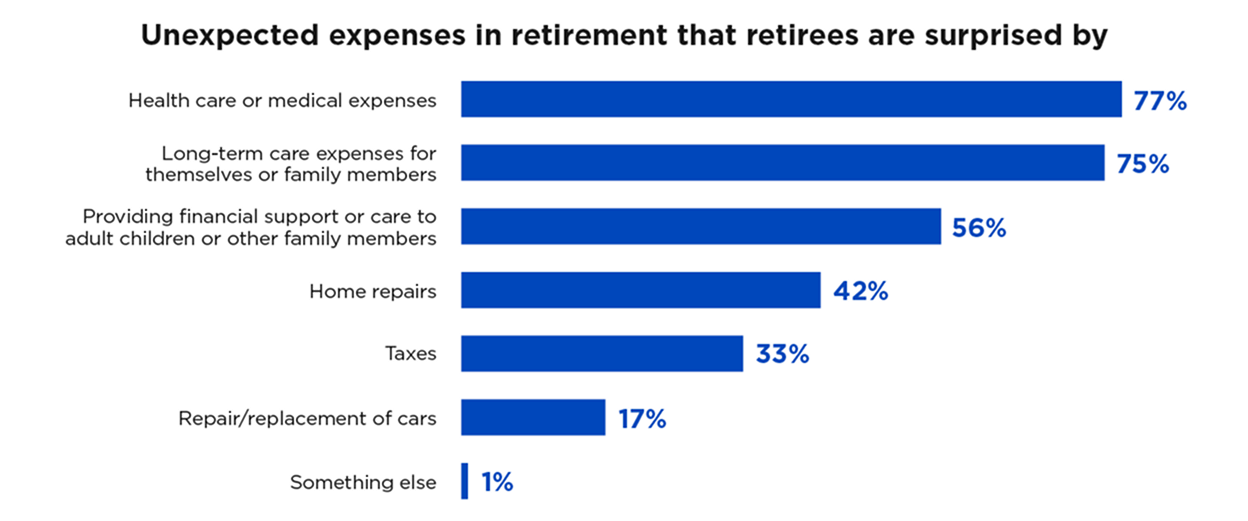

In fact, a recent survey found that 3 out of 4 financial professionals say their clients are often surprised by large health care or long-term care expenses in retirement.1 Unexpected medical bills, long-term care needs and support for family members all rank high on the list of spending shocks — expenses that can quickly drain resources and disrupt even a well-structured retirement income plan.

Understand the potential consequences

The problem with spending shocks isn’t just that they’re unexpected. It’s that many retirees don’t have a plan for how to pay for them.

When there’s no clear strategy, clients may pull from the easiest source of cash — often a tax-deferred account. But doing so without thinking through the tax impact can lead to unintended outcomes such as jumping into a higher income bracket, triggering higher taxes on Social Security benefits or increasing Medicare surcharges.

That’s why conversations about spending shocks should happen early and often. When clients understand that these events aren’t just possible but likely, they’re more willing to explore strategies that make it easier to handle them without creating new problems.

Sources: "2023 Retiree Insights Presentation to Nationwide," Greenwald Research (August 2023);

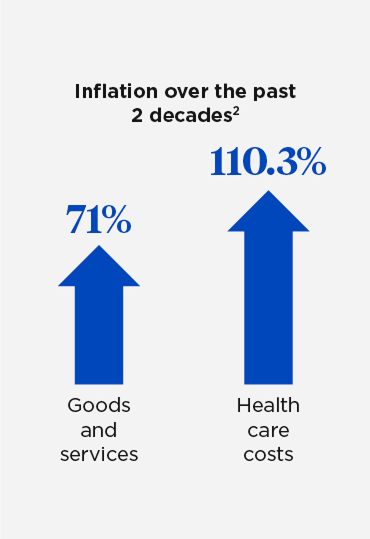

"Inflation is (finally) hitting health care," advisory.com/daily-briefing/2022/08/30/healthcare-costs (March 18, 2023).

Strategies to tackle unforeseen retirement expenses

A personalized combination of these planning strategies can help clients better prepare for unexpected costs:

- Build a recurring level of surplus retirement income compared with anticipated retirement expenses

- Review insurance coverage and help identify gaps that could result in large out-of-pocket expenses that might be challenging to cover from regular monthly income sources

- Right-size an emergency fund to each retiree’s needs, and ensure that funds can be accessed quickly

Consider more than just liquidity

Part of the planning conversation should focus on liquidity, but not just whether a client can access a particular asset. The real question is what it costs to access that money.

After all, there’s an important distinction between technical liquidity and true liquidity:

- Technically liquid assets are currently being used to generate regular retirement income. Using these assets for an emergency will reduce regular retirement income.

- Truly liquid assets aren’t being used to generate regular retirement income. Using these assets for an emergency won’t impact future retirement income.

For example, pulling from a traditional IRA may be technically possible, but the tax consequences could be steep, especially if the withdrawal is large or poorly timed. And if those IRA investments were producing needed monthly income, that future level of income will be lower. Clients at higher risk of incurring large expenses could instead focus on increasing their levels of truly liquid assets to help minimize those costs and maintain better control over their retirement income.

Plan for rising health care and long-term care costs

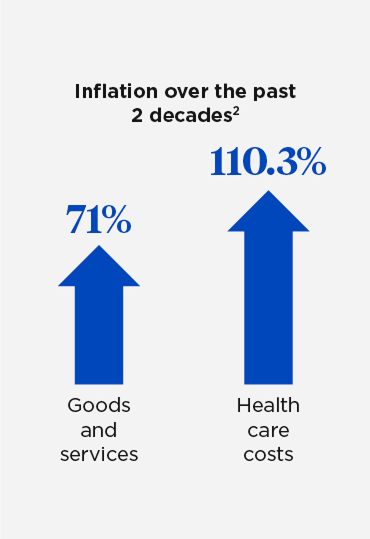

Out-of-pocket health care and long-term care expenses are increasingly the wild cards of retirement income planning. Not only are they among the top spending shocks, but they’re also growing faster than other expenses.

That makes flexibility an even more critical part of each client’s plan. Whether due to federal policy changes, client health events or both, odds are that many retirees will need to grow their savings to cover the ever-increasing cost of health care.

One way to build in this flexibility is by including a mix of income sources: taxable, tax-deferred and tax-free. This gives you more levers to pull when a spending shock happens and allows you to manage the tax impact more efficiently.

Over the past 20 years, health care costs have risen more than 110%, compared to 71% for all other goods and services.2 As people live longer, the need for long-term care becomes more likely. For instance, many clients don’t realize that Medicare doesn’t cover most long-term care services, which makes planning even more critical.

Help clients get ahead of surprises

Spending shocks can’t always be avoided. But the financial stress they cause can often be reduced or prevented with the right plan. When you help clients identify the types of expenses that could catch them off guard — and build a strategy for how to fund them — they gain more confidence and control. That’s one of the best outcomes a retirement plan can deliver.

For more detailed insights,