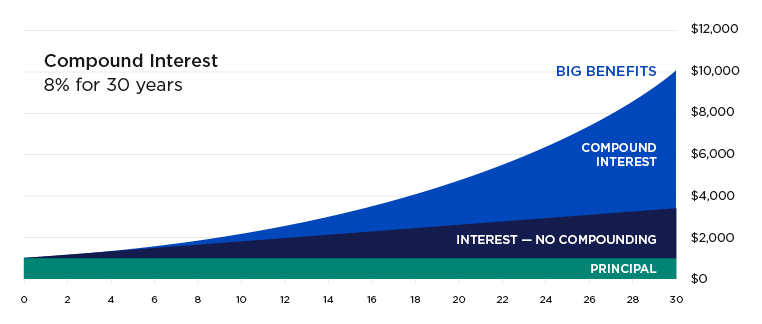

Compounding can be a powerful engine for account growth

How it works in your retirement account

The sooner you invest, the more time your money has to grow.

Enroll in your plan or log in to increase your contribution today.