Volatility can feel like a roller coaster — thrilling highs, stomach-dropping lows, and moments where you're holding on for dear life. Now, volatility isn't all bad. After all, without some risk, there wouldn't be any potential for reward.

Investing is all about balancing that risk and reward. You might take big risks that result in big rewards, but there's also a chance those risks could lead to big losses. That's why many financial professionals agree, playing the long game is often one of the best investing strategies.

You can better understand volatility by monitoring the VIX. The CBOE Volatility Index, or VIX, is commonly known as Wall Street’s “fear gauge.” It reflects investor sentiment on market uncertainty. Generally, a higher VIX indicates greater fear and uncertainty in the market, and a lower VIX suggests a more stable environment.

Behavioral biases and their impact on investing

Watching your investment values drop during a market downturn can cause anxiety and stress. Those are natural reactions. In fact, about 30% of retail investors panic-sell during market downturns.1

These reactions are driven by what experts call behavioral biases. Our brains are wired to protect us from danger, and a plummeting stock market can trigger a fight-or-flight response. This is where the guidance of a financial professional can be invaluable, helping you separate emotions from sound investment decisions.

Did you know: Market pullbacks are quite common. In fact, each has its own catalyst; on average, since 1950, the market experiences a 5% pullback approximately three times per year! By bailing out early, you could miss out on the recovery.

Mac and Mini: The power of patience

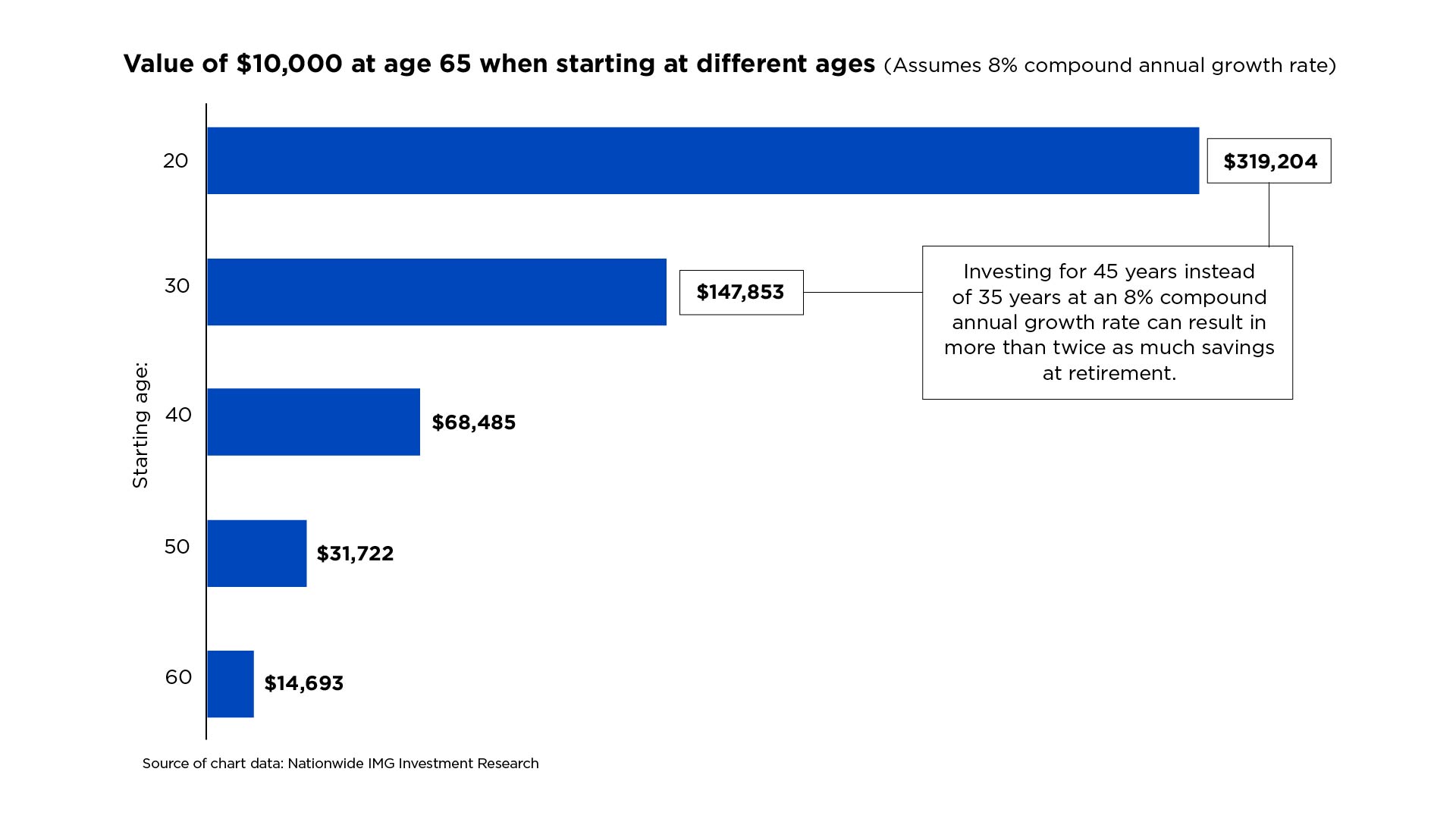

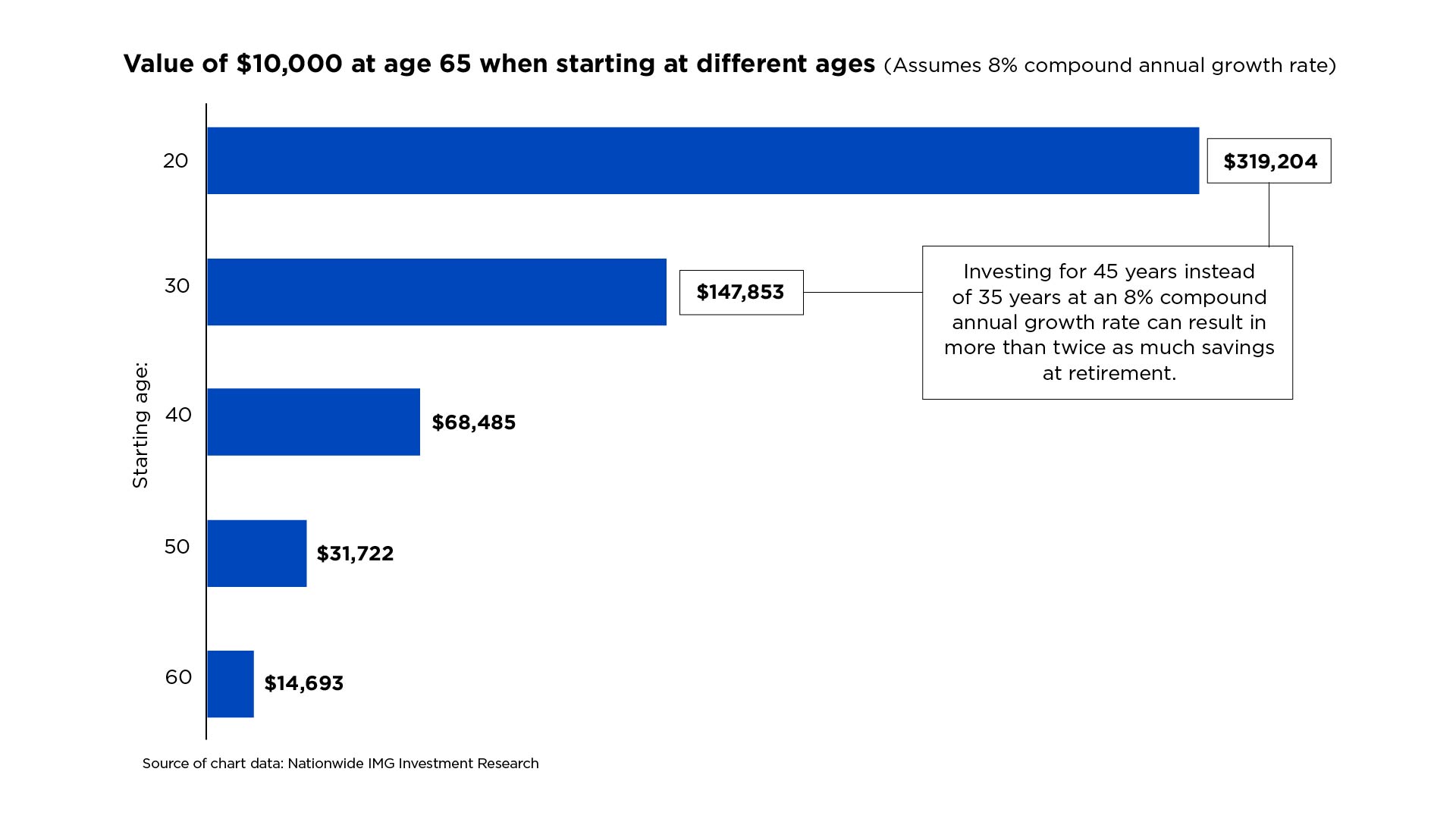

Let’s look at a hypothetical example: Mac and Mini are a 65-year-old couple who've been investing in an S&P 500® Index mutual fund for the past 45 years. By staying invested through the market's ups and downs, they've enjoyed average annual returns of 8.00%. As the chart below shows, the earlier you start and the longer you stay invested, the greater your potential returns over time.

The cost of missing out

Investors can easily get lost in the frenzy of a sell-off, overwhelming rational investment decisions; missing just the 10 best days in the market over a 20-year investment period could cut your overall returns in half. Keep in mind, a phenomenon called "rebound days” often occurs immediately after significant market declines. By not being in the market on these rebound days, you’re more likely to miss out on significant gains.

Imagine an alternate scenario where Mac and Mini panicked during a major market downturn and missed just the 10 best days of market recovery. Their returns likely would have been significantly lower.

Strategies to help you stay the course in volatility

A financial professional can help you develop strategies to navigate market volatility and feel more confident in your long-term investment and retirement plans when markets decline:

- Embrace a long-term perspective: Remember Mac and Mini’s story. The stock market has historically trended upward over long periods, despite short-term volatility.

- Practice dollar-cost averaging: This strategy involves regularly investing a fixed amount, regardless of market conditions, which can help smooth out the impact of market fluctuations over time.

- Diversify your portfolio: Spread your investments across different types of assets. When one area of the market is underperforming, another may be doing well, helping balance out the effects of a downturn.

The power of staying invested

Mac and Mini’s story isn't just about performance over time; it's about the power of patience and perseverance. Simply put, patient investors who stay the course are often rewarded for their steadfastness.

Since its inception in 1928, the S&P 500® Index has delivered an average annualized return of 9.90%.2 Even during the worst 40-year period (1969-2008), it still provided 4.2% annual returns.3 A financial professional can help put these figures into perspective, showing you how they relate to your personal financial goals and risk tolerance.

Be confident in your financial journey

By sticking with their investment strategy despite market swings, Mac and Mini were able to harness the power of long-term market growth. While past performance doesn't guarantee future results, history has shown that time in the market is often better than trying to time the market.

As you navigate your personal financial journey, consider partnering with a financial professional to help you develop a long-term investment strategy tailored to your investing and retirement goals, appetite for risk, and how long you plan to stay invested. With the right professional guidance, you can navigate market volatility with confidence and keep your financial goals on track.

Your financial future is a marathon, not a sprint. Stay focused, stay invested, and let time work in your favor. After all, the best day to start investing was yesterday. The second-best day? Today.