Home insurance resources

From buying a house to avoiding a house fire, our helpful tips and information can save you money and keep you safe.

Get a quote

Home resource categories

Homeowners insurance

What is an insurance endorsement?

An insurance endorsement, or rider, is a change to an insurance policy. Learn more about the common types of endorsements.

Benefits of tree maintenance

Learn about the safety benefits of routine tree maintenance and how to prevent property damage in the event of a disaster.

Fall home maintenance checklist

Learn how to prepare your home for the cold winter months. Follow this fall home maintenance checklist to ensure your house is in peak condition this winter.

Types of CO and smoke detectors & where to install them in the home

Explore the different types of carbon monoxide and smoke detectors and review where they should be installed throughout your home. Learn more today.

What are your roof coverage options?

We offer roof coverage with a variety of coverage and premium levels. Explore the options to see which one may be right for you.

What is umbrella insurance?

Learn about the benefits of a personal umbrella insurance policy today.

What impacts your insurance rate?

Learn what factors can affect your premium and how you may be able to lower your rate.

Handyman vs. general contractor: What’s the difference?

Learn which you should hire, a handyman or a contractor in this guide.

5 Tips to prevent basement flooding

Discover ways to prevent costly basement water damage.

How much does a roof replacement cost?

Discover average roof replacement costs and important variables to consider such as the size of the roof and/or materials.

Changing homeowners insurance with an escrow account

Discover how you switch homeowners insurance providers with an escrow account.

Cheap homeowners insurance

Learn how you can find affordable home insurance coverage you can depend on.

Do I need a declaration page?

A homeowners declaration page offers proof of homeowners insurance with a summary of coverage and limits.

Read in case of fire

Review what is covered and how to submit a claim when it comes to fire in a home.

Does homeowners insurance cover tree removal?

Learn more about tree removal and what you can expect from insurance.

Does homeowners insurance cover foundation repair?

Learn more about foundational damage and if your homeowner’s insurance covers it.

Costly water damage?

Find out what you can do to help prevent damage in your home.

How much is homeowners insurance?

Take a look at some of the factors that determine how your homeowners insurance is calculated.

Is homeowners insurance tax deductible?

Homeowners insurance is tax deductible most of the time, but there are exceptions.

Filing a claim

Get 7 tips for filing a homeowners or renters insurance claim.

Marriage & your insurance needs

Learn five ways that Nationwide meets the needs of newly-married couples.

Protect your investment in a rental property

Find out if your homeowners insurance covers rental property.

How much homeowners insurance do I need?

Estimate how much homeowners insurance is right for you.

What is hazard insurance?

Learn about hazard insurance, what it covers, and how it differs from homeowners insurance.

Types of homeowners insurance

Know the basics of home insurance coverage.

What is property and casualty insurance?

Learn about property and casualty insurance and what it covers.

What is personal liability insurance?

Understand what is and isn't covered in your homeowners or renters insurance policy.

Insurance claims FAQ

Find answers to frequently asked questions about Nationwide property and auto insurance claims.

Insurance FAQ

Find answers to questions about your Nationwide insurance policy.

Property insurance glossary

Understand definitions of key terms for insuring your home or business.

What is dwelling insurance?

Understand what dwelling insurance covers and whether you need it.

What is homeowners insurance?

Learn about homeowners insurance and what it covers.

Glossary of insurance terms

Learn the basic language of the insurance business, including common terms you’ll hear as a policyholder.

Understanding the parts of a policy

Insurance policy documents appear to be very complex. Use this simple guide to help you make sense of them.

Does home insurance cover theft?

Find out whether homeowners insurance covers theft.

Homeowners insurance FAQ

Get answers to common homeowners insurance questions.

Does homeowners insurance cover water damage?

What type of water damage is covered by homeowners insurance? Find out what types of water damage are covered by homeowners insurance.

What is loss of use insurance?

Discover what loss of use insurance is and an explanation of loss of use coverage from Nationwide.

Do I need ordinance or law coverage?

Understand how ordinance or law coverage works and if you need it with your homeowners insurance.

Lower your home insurance rates

Read the simple steps that you can take to impact how much you pay for your homeowners insurance.

Disaster insurance coverage

Consider these 6 tips to determine whether your homeowners insurance will cover a catastrophe.

Does homeowners insurance cover termite damage?

If you own or are considering buying a home, get the facts on homeowners coverage and termite damage.

Common homeowners insurance mistakes

Avoid overlooking important details when searching for the best deal.

Filing a homeowners claim

Be prepared for if the unthinkable occurs and you need to start a claim.

Annual home insurance review

Find out how an annual insurance review can ensure your property is protected.

Do I need vacation rental insurance?

Find out if you need coverage for your second home or vacation rental property.

What you should know about insuring musical instruments

Learn the different ways you can get your musical instrument insured.

Landlord insurance covers a range of situations

Learn what landlord insurance covers and how it differs from homeowners insurance.

What is loss assessment coverage?

If you own a condo, you should learn about the protection loss assessment coverage can offer.

Downsizing from a house to an apartment

Moving from a house to an apartment might cost you space, but it doesn’t have to cramp your style.

Does homeowners and renters insurance cover jewelry?

Find out if your insurance policy will protect your jewelry or engagement ring.

Buying a house without a real estate agent

These days, buying a house without an agent isn’t uncommon, but is it the best move for you?

Are you covered during your move?

Will homeowners insurance protect you during the moving process?

Does homeowners insurance cover mold?

Learn about the different scenarios when homeowners insurance covers mold damage.

Renters insurance

Simple ways to make your apartment door more secure

Discover these easy tips to help your apartment feel safer and more secure.

Does renters insurance cover storage units?

Find out whether renters insurance covers storage units.

How much renters insurance do I need?

A renters policy can help protect the furniture, belongings and valuables you bring with you into a rented space.

Need proof of renters insurance?

Learn about coverage and limits of a renters declaration page.

Do I need renters insurance and how do I get it?

Get help determining whether you need renters insurance and how to get it.

How much is renters insurance?

Take a look at some of the factors that go into a renters insurance quote.

Does renters insurance cover theft?

Find out whether renters insurance covers theft.

Renters insurance and bed bugs

Find out whether renters insurance covers bed bugs.

Renters insurance FAQs

Common questions around renters insurance.

What is renters insurance?

Learn about renters insurance and what it covers.

First time rental advice

Our guide for first time renters to navigate the rental market.

Renting a condo

Avoid the hassle and follow these condo rental search tips.

Before you rent your first apartment

Check out these first apartment tips on budgeting, maintenance and more.

How to move out for the first time

Find important advice on how to successfully move out on your own.

How to be a landlord

First time landlord tips.

Do you need renters insurance for a college dorm?

As your child prepares for campus life, here’s what you should know about student renters insurance.

Condo insurance

What is condo (HO-6) insurance?

Learn about different available condo insurance policies and what’s generally included.

What does condo association insurance cover?

Condo association insurance is an important policy for anyone that owns a condo.

Are you a condo owner?

Many wonder if their condo insurance is tax deductible.

Do condo owners need homeowners insurance?

Learn more about the differences between condo insurance and home insurance.

Unexpected costs condo owners may incur

Learn about special assessments in addition to monthly fees to maintain the property.

Buying & selling

Tips for downsizing your home

Curious about how to downsize your home? Discover practical tips to help you plan, declutter and transition smoothly into a smaller, more manageable space.

Out-of-state moving checklist and tips

Follow our step-by-step checklist to stay organized, cut stress, and make your relocation smooth from start to finish.

How much do you need to save for a down payment on a house?

Buying a home can be a stressful process. Learn how much you need to save for a down payment and understand the requirements for various types of loans.

What are closing costs?

Mortgage closing costs can be daunting. Learn what they include, typical amounts, and how to prepare.

What is a home inspection and what is included?

Whether you’re buying or selling, learn the basics of home inspections.

Buying a house?

Read these home buying tips for first time homeowners.

When to get a home appraisal

A property appraisal may save you money – not just when buying a home.

Home selling tips

Learn the steps you can take to help get the best price for your home.

Pay off your mortgage faster

Learn how to build equity, save interest and pay off your mortgage early.

First time home buyer guide

Learn what to expect when buying your first home.

Bidding on a house

Use these tips to navigate the home-buying process for your next home.

Should I refinance my mortgage

See what to consider when determining if refinancing a house is right for you.

Tools to estimate the value of your home

Learn about the tools you can use to best estimate the value of your home.

What you should know about dual agency

If you’re working with a real estate agent to buy a house, you should know about the impact of dual agency.

Change of address checklist

If you’re moving, find out who you need to contact with your new address with this helpful checklist.

Negotiating realtor commission

Learn how to negotiate realtor fees to help you save on your home sale or purchase.

10 steps to becoming a landlord

Increase your income with these 10 steps to becoming and thriving as a landlord.

Should you move or remodel your home?

Find advice on how to decide between renovating your home or buying a new one.

Five rules for renting out your home

Check out these five things to include in rental contracts.

How to set up utilities

Learn how to set up electricity and other utilities in your new home.

Tips for downsizing

If you set priorities and follow a plan, you’ll have an easier time downsizing your home.

How to flip a house

Here are six tips to know before flipping a house.

The importance of the due diligence period

Learn about the due diligence period and how to use the time effectively.

How to transfer utilities

Learn how to switch utilities into your name after you move.

Second home tax deductions

A second home can mean eligibility for deductions.

Should I buy a vacation home?

Here are 6 things to keep in mind if you’re considering a vacation home.

Who builds your new house?

The home contractors you need for building a new house.

Understanding the parts of a home appraisal process

The home appraisal process is essential for buying and selling a home. See what you need to know.

Home inspection tips for buyers

Learn the eight home inspection red flags that could be deal breakers.

How to buy a house with little to no down payment

Learn about these home loan programs that may be able to help your situation.

Home equity lines of credit and home equity loans

Learn what the differences are between home equity lines of credit and home equity loans.

Saving for your first house

Learn how to save for your first house and get the home you want.

How to find a real estate agent

Before you find your dream home, you’ll need to find some help! Discover how to find a real estate agent.

Safety & protection

How to prevent grease fires and what to do if they happen

Discover essential kitchen fire safety tips, including how to prevent, handle and extinguish grease fires to help keep your home and family safe.

Outdoor fire pit safety tips

Learn about types of outdoor fire pits and the potential fire hazards they may pose. Find safety tips to help protect yourself and your loved ones.

Pellet stove safety

Learn how to safely maintain and use a pellet stove with these tips.

Wood stove safety tips

Learn about the proper installation, operation, ventilation and maintenance of a wood burning stove.

Fire extinguisher safety

Find out about the different types of fire extinguishers and how to use them.

Fire safety tips

Protect your house and family with these fire safety tips.

Hot water heater safety

Learn about proper water heater maintenance to keep things running smoothly.

Electrical safety tips

Stay safe when it comes to your home electrical wiring.

Trampoline safety

Discover how to properly use trampoline safety pads, nets and more.

Senior citizen safety tips

Get senior safety tips to remedy the safety challenges seniors face.

Childproofing your home

Follow these home safety tips to help prevent your children from being hurt.

Grill safety tips

Following these grilling safety guidelines can help prevent the risk of fires.

Pool safety tips

Practicing proper pool safety habits is critical.

Appliance safety tips

Learn how to safely care for your appliances.

Child safety tips

Learn how to prevent common injuries.

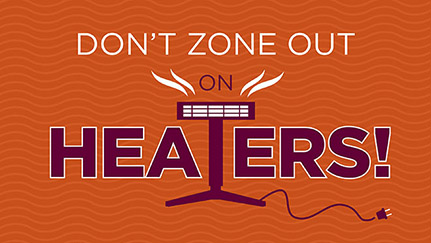

Space heater fires

Take a look at our colorful infographic with tips on how to use a space heater safely.

Sports safety tips for kids

Learn 10 good ways to help ensure your child’s safety and prevent sports-related injuries.

Home remodeling safety

Practice these precautions to stay safe while remodeling your home.

Reduce electrical fire risk

Learn what upgrades you can make to help prevent an electrical fire in your home.

Home burglary

Get helpful tips on protecting your home from burglars.

Prevent identity theft

Identity theft happens every day. Learn how to protect yourself.

Home security while you’re away

Follow these security tips to keep your home safe and trouble-free while you’re traveling out of town.

What is an attractive nuisance?

Learn what an attractive nuisance is and how to minimize the associated risks.

Home security system buying guide

Here are the questions you should be asking when shopping for a home security system.

College dorm safety tips

Get the peace of mind that these college safety tips provide.

How does a sump pump work?

Learn about what a sump pump is used for.

Wildfire safety tips for homeowners

Knowing how to prepare for a wildfire can help keep your family and home safe.

Is your home wifi network secure?

Get a personalized cyber security assessment and tips how to protect yourself.

Care & maintenance

When to replace your roof

Don’t wait for a leak before replacing your roof. Learn how often to replace your roof and catch early signs of damage.

How to pressure wash a house

Read our guide that provides tips on pressure washing a house. Learn about safety gear, when to hire a professional and other frequently asked questions.

What to do when a pipe bursts in your home

Discovering a burst pipe can feel like a worst-case scenario for homeowners. Learn what to do when a pipe bursts in your home.

Common plumbing problems and how to fix them

Learn about common plumbing problems, where to look for signs and how to prevent them.

How to choose a home inspector

Learn how to choose the right home inspector for the safety of your future home.

How to drain a water heater

Learn how to drain your hot water heater today.

Can you write off home improvements?

Know what repairs and home improvements are tax deductible.

Protect your pipes

Get tips on keeping your pipes from freezing during the winter.

Home heating tips

Use these home energy saving tips to lower your monthly energy bills.

Different types of roofing

Learn about 9 different types of roofing options and the benefits of each.

Identifying signs of roof damage

Discover ways to identify and fix common types of roof damage.

8 Questions to ask before adding onto your house

Find out the important questions you should be asking when making home addition plans.

Empty nester house plans

Here are some ways you can make use of space in your house after your children move out.

Solar panel insurance

Homeowners interested in renewable energy should know whether home insurance covers solar panels.

Tips for dealing with contractors

Learn how to work with contractors when you’re building a home.

Specialty & pet

Valuables Plus®: Valuables insurance to keep your treasured items safe

Wondering if your home, condo, or renter’s insurance protects your treasured possessions? Valuables Plus® offers added coverage for jewelry, art, and more.

Protection Boost: Expanded home coverage

Learn more about our Protection Boost coverage for life’s unexpected losses

The benefits of pet insurance

Here’s why and how to protect your pet from the unexpected.

Why you should consider wedding insurance

Find out the different types of wedding insurance coverages and the benefits of a wedding insurance policy.

Saying "I don’t" to wedding debt

Learn the types of wedding debt you should try to avoid when planning your big day.